So, in the last couple of weeks I have been asked about flipping houses!

When I say flipping houses I’m on about buying and selling within a timeframe, sometimes with refurbishment and sometimes without. So here are a few basics.

- Flipping works best when buyer demand is low and property supply is high.

- Flipping works best when purchasing using cash. If you are looking to flip a house within 12 months using finance, a bridging loan will be required.

- Flipping works well when material costs are low and supply of these materials is constant.

- Flipping works well when the conveyancing process is slick and fall throughs of completed sales are minimal.

- Flipping really works when house prices are moving upwards quickly.

The more of these things line up the better chance you have to make a profit. So where are we in the local market at the moment?

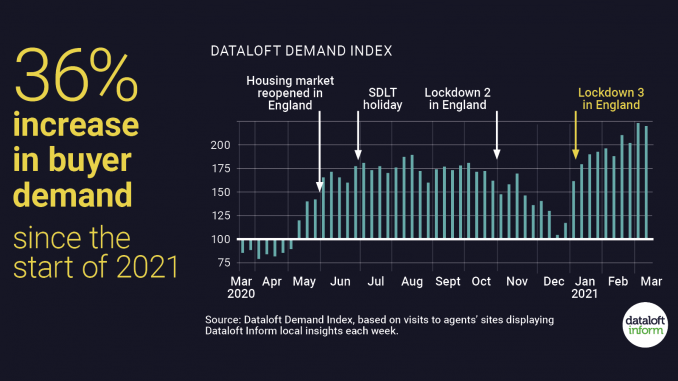

- Supply is lower than average and demand from buyers is high.

- Cash needs to be traceable else it will not pass Anti Money Laundering checks.

- Bridging loans are more expensive than buy to let mortgages.

- Buy to let mortgages will need to run at least 12 months before another buyer can use mortgage finance on the same property.

- Material costs are up 20% to 30% and supplies are inconsistent.

- The conveyancing process is oversubscribed.

- House prices are moving forward at pace.

Like most things in life, choosing when to flip a property is all about timing.

You may come across an opportunity to flip a property where more of the above line up than do not, if you need any help in understanding the value of a home pre-flip and post flip, call us here at Tortoise Property Limited on 01733 592020.

Mike Matthews

Tortoise Property

01733 592020