Hello everyone, I’m Sam. I’m new to Tortoise Property and Estate Agency. I have a BA Honours Degree in Marketing from Sheffield Hallam University and wanted to find somewhere that I can put that to use, which is why I’ve ended up here!

This blog will be a weekly series of me recounting my experiences, explaining why great marketing is so powerful when selling your home and the exciting plans I have for the future of marketing in Estate Agency. I believe this will be beneficial to me as I write down everything I do and hopefully will be to you also, as I do my best to explain Tortoise Property, convey our difference and answer any estate agency questions that anyone may have.

- An online valuation of your home in 60 seconds!

- Personal assessment of your home with Tortoise Property!

- Are we the right Estate Agent for you? Take the quiz!

- Connect and stay up to date with all things Tortoise!

Welcome to Episode 7!

We’ve moved past our Phased Marketing Model and the individual sections of it now. If you missed it and want to check them out then click here!

Today we’re taking a look at how we value a property.

Now for those of you who are recent customers (or just big Tortoise fans), you’ve probably seen our valuation model. For those of you who haven’t, it’s pictured for you below.

What is it?

Effectively, it’s a diagram covering the three main areas we use to price a property. These are:

Your Online Valuation: The tool gives us (and you) three prices; a minimum price, an average price and a maximum price using an algorithm that assesses property prices locally. This is beneficial since it gives us a nice range to work from and get an idea of where roughly we should be looking at. It is also similar to the tool used by lenders to assess a property for lending for a desktop valuation.

The Average Increase / Decrease of a Postcode: Dataloft is an excellent tool. It provides the average price increase / decrease of properties in your postcode, meaning we are able to get a good idea of how much your home is likely to be worth today compared to the purchase price.

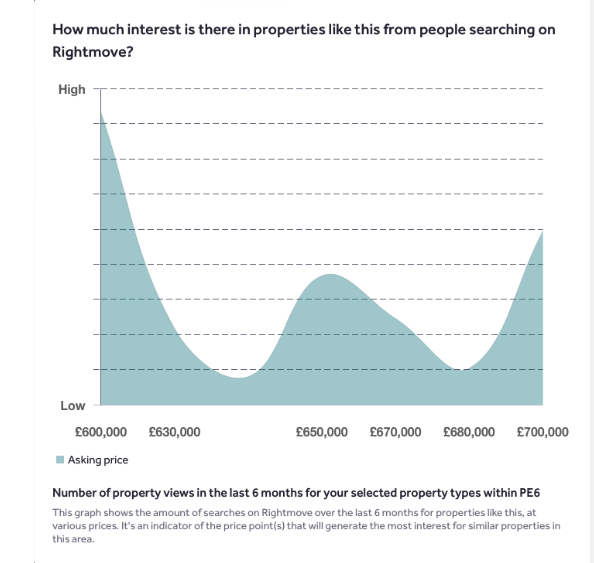

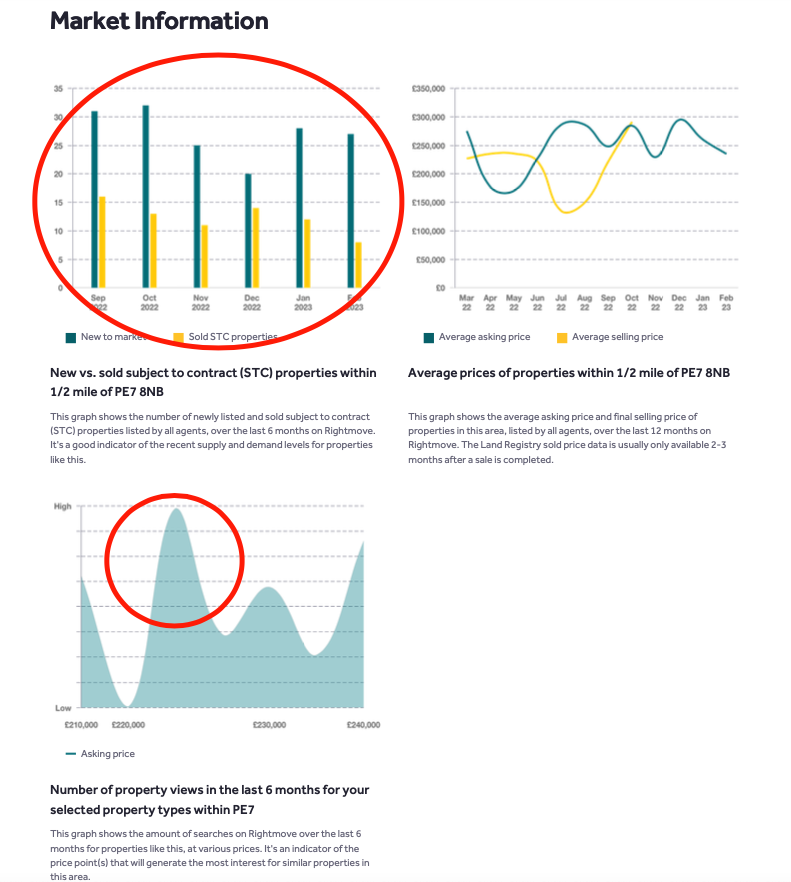

Price Comparable Report: The part that gets all the glory! The price comparable report is generated by OnTheMarket and will often be the document we bring with us when we come to value your home. It contains properties similar to your own which are on the market or have recently been sold. This allows us to directly compare your home (as long as we know what it looks like!) with other properties of a similar type. We’re then able to understand what the best price to market your home will be. Also included in this report, are some graphs / data provided by the portals. They show information about the current demand at a specific price range as well as an average price of properties within the vicinity of your home. It’s important to note that this is vital information to be included when deciding on a value for a property. To sell the property, the demand has to be available! Below are a few examples of this.

Finally, just to note these are not ALL of the areas we look at when pricing a property, but the three main ones. We utilise experience, some mathematics and an assessment of current market conditions. At the end of the day you just have to make a judgement call based on the information currently available. Take everything you’ve gathered from the research and the price point will normally be identifiable. As long as it’s sensible and you can validate the reason why you’ve suggested this price; you will find a demand point when marketing the home for sale.

The importance of getting it right the first time:

Pricing can be a slippery slope. If the property is priced incorrectly the first time, the likelihood is that it will eventually be reduced. The problem is once you do this, there’s only one way to go; and it isn’t up! Once reduced, it’s far more likely that offers will come in under the new reduced price as buyers sense good value!

To avoid this, it’s best to try and price the property correctly, the first time. This could be at the perceived price of value or just slightly under. The reason for this is that say for example you get interest in the property from multiple buyers, they may begin to compete with each other and therefore you eventually end up at the price you wanted anyway.

If you really want to move or need to move, I cannot stress the importance of pricing your home correctly; especially in the current marketplace.

So why do we do it this way?

This is about checks and balances, about understanding the demand of prospective buyers and the effect financial mortgage markets have on affordability. It’s about understanding how different locations, different properties and different demands come together into different price points.

No one knows exactly (to the penny) what a home will sell for, not even Mike! So, the best we can do is set a price range that is appealing to buyers in the current market and give a sensible range of where we expect to receive offers and negotiate and agreement from this point.

Buyer’s, Seller’s and Balanced Markets:

I’m sure most of you already know about these but just in case you don’t, I’ll discuss them briefly for you.

Buyer’s Markets: A buyer’s market is when supply exceeds demand. Basically there are too many houses and not enough buyers for them. Sellers in this market tend to lower their prices to gain an advantage.

Seller’s Markets: A seller’s market is when demand exceeds supply. Effectively there are not enough houses available and therefore sellers have the advantage.

Balanced Markets: Supply and demand are about equal. Sellers usually accept reasonable offers and houses tend to remain on the market for an average length of time.

Currently we’re in a buyer’s market in 2023 rather than the sellers market of 2021 /2022. The thing is it’s a bit of a strange one. As I already mentioned, buyers have plenty of choice at the moment when it comes to properties, but this has become more restricting recently due to the high mortgage rates brought on by high inflation.

To Conclude…

And there you have it. That’s my brief rundown of how we price a property here at Tortoise. If you have any questions or would like to learn more then feel free to get in touch with either me on my LinkedIn below or the office on 01733 59 20 20.

Thanks for taking the time to read this blog!

Looking for some next steps? These links could be useful:

- An online valuation of your home in 60 seconds!

- Personal assessment of your home with Tortoise Property!

- Are we the right Estate Agent for you? Take the quiz!

- Connect and stay up to date with all things Tortoise!

If you have any questions or topics you would like to see me discuss in the future, then please do get in touch. I’m more than happy to connect with marketers, whether you work in my industry or not, as well as industry experts who I myself could learn from. You can connect with me on LinkedIn here.