Inflation, a measurement that has been controlled by the Government like a lion tamer in a circus, so that each government would have us believe. The government (labour and conservative) have expertly managed to keep inflation below its target of 2% for what feels like forever, well since I was in my 20’s. Explaining that controlled low inflation is good for everybody’s financial health, which is correct in many ways, but not all.

However the lion tamer has now lost his whip and had his arm bitten off! So bring in the clowns, we should expect a bit of fun and games in front of us.

So the real reason inflation has been under control for so long has been due to the global trade agreements and the flow of goods, materials, fuel and food around the world that has been conducted in a general seamless manner. However when another international partner decides not to play ball control of inflation is lost. First of all Covid caused the supply chains around the world to falter, more locally Brexit caused the same issues between ourselves and the EU and then the war between Russia and Ukraine has gone onto effect fuel supplies, food supplies and mineral supplies.

So what does this have to do with landlords?

Let’s start with mortgages

We are seeing mortgage rates rise due to the cost of providing lending along with rises to the Bank of England base rate. Many landlords use short term 2 year fixed rate products that will be effected by the rises. Interestingly 5 year deals can be found that are only 0.25% to 0.50% more expensive than 2 years deals (UK Virgin Money 11/6/2022) showing that there is an expectation that inflation will be controlled past the short term period of two years?

However we should expect the cost of lending to be progressively more expensive when re-mortgaging over the next 18 months while the world experiences the turbulent times that we are living through.

Tenants

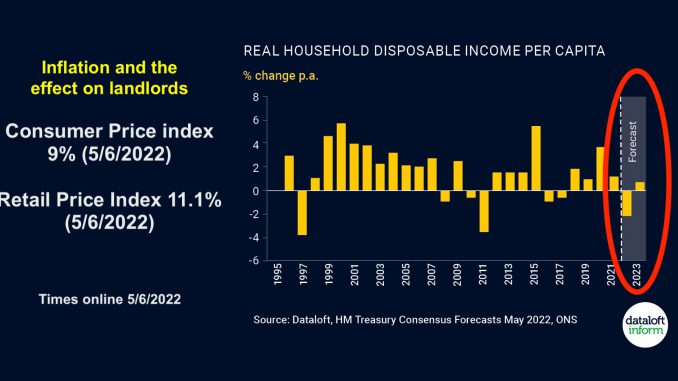

The cost of living crisis (inflation) will cause a re-adjustment of spending habits for many tenants with the real household disposable income per capita forecast expecting a sharp decline. Many tenants may cope however some are expected to struggle as the reality of increased prices bites into everyone’s disposable income.

The Times reported on a Which survey on the 27/4/2022 showing that 6% of renters had missed their payment date and 5% of all consumers had missed a bill payment within the last month.

Expect the cost of rent and legal products to rise over the next 12 months if claims rise. We may also see products withdrawn as we saw during Covid if we see staples like food and fuel rise uncontrollably in the third or fourth quarter of this year. Be prepared as cover can not be bought retrospectively.

Materials and labour

We have seen rises of 20%-30% in the cost of varying materials over the past 12 months and expect a rise in labour costs due to inflation pressures.

Expect to pay more for all required maintenance works, refurbishments and improvements to your investments.

Servicing costs

Professional servicing costs are expected to rise from the use of accountants, management services, letting services, brokers, building insurance and more.

Expect increases in professional services across the board.

So how do you deal with the extra costs?

Use the recent past to pay for the near future. We have seen 12% + (average) increases in the rents being paid by tenants and rises of 10% + (average) in property prices in the last 24 months (Dataloft) in Peterborough. I’m afraid you will not be able to keep all of these increases (I know you want too!).

Costs will always rise along with increases in rental prices. Inflation effects most things rather than just the things that will make you money. Use the increases to pay for the everyday increases of costs in materials, labour and professional services. Use the chance to re-mortgage to use a percentage of this increase to fund refurbishment and to increase your investments.

And how do you deal with all the consequences of inflation?

I’m expecting more demand from tenants that require homes and more professionally run properties available to them due to an increase in the use of selective licensing by local councils to maintain standards.

ALSO

I expect a little more inconsistent behaviour shown by tenants due to the financial pressure being driven by the cost of living crises.

SO

Be professional, do not cut corners and do not be greedy, you will be caught out! I expect property investments to continue to produce great returns for professional landlords. Being professional does not mean you swop your job to be a property investor full time. It does mean you run your portfolio correctly working in partnership with providers that cover all your bases.

If you would like to discuss and chat about what is required in 2022 to set up a professionally organised rental property give us a call at Tortoise Property on 01733 592020.

Mike Matthews

Tortoise Property