I’m forever blowing bubbles,

Pretty bubbles in the air,

They fly so high, nearly reach the sky,

Then like my dreams they fade and die.

A song written in 1919 in the States and made famous in the music halls of Britain in the 1920’s. Football fans will instantly relate the tune to West Ham United however the song could have also been adopted by the UK press when discussing the housing market cycles.

So where are we in the cycle of housing bubbles, is the bubble rising, fading or ready to burst?

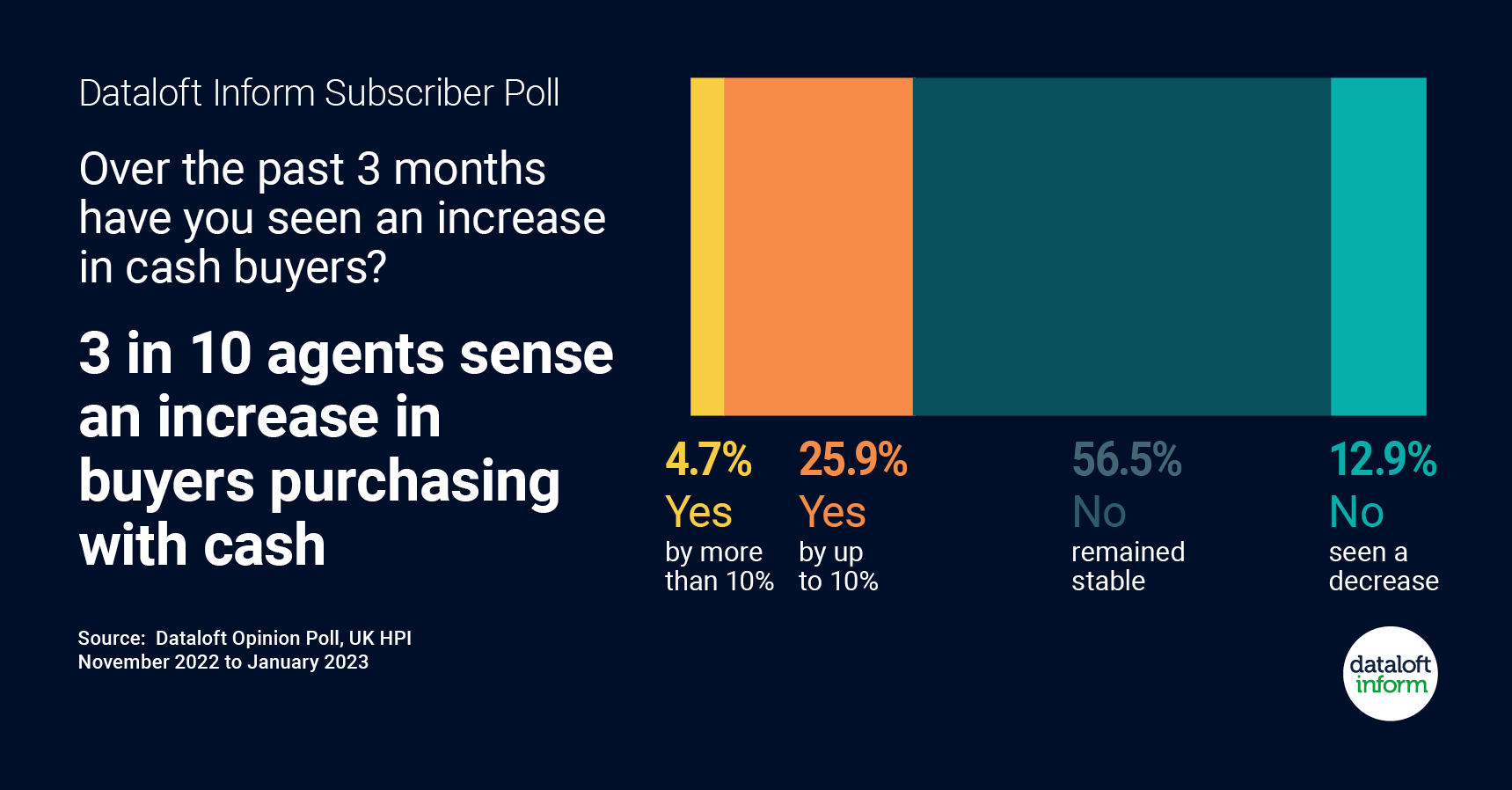

Are there more cash buyers in the market?

BUBBLE ANALYSIS: Mixed. There were differing views on the number of cash buyers in the market. The vast majority of the agents felt that there was no change in the number of cash buyers, but 25.9% believed there was an increase of up to 10%. This increase could be attributed to premium London agents primarily dealing with cash buyers or to an uptick in investors, both from within the U.K. and overseas, likely spurred by the devaluation of the pound observed in 2023.

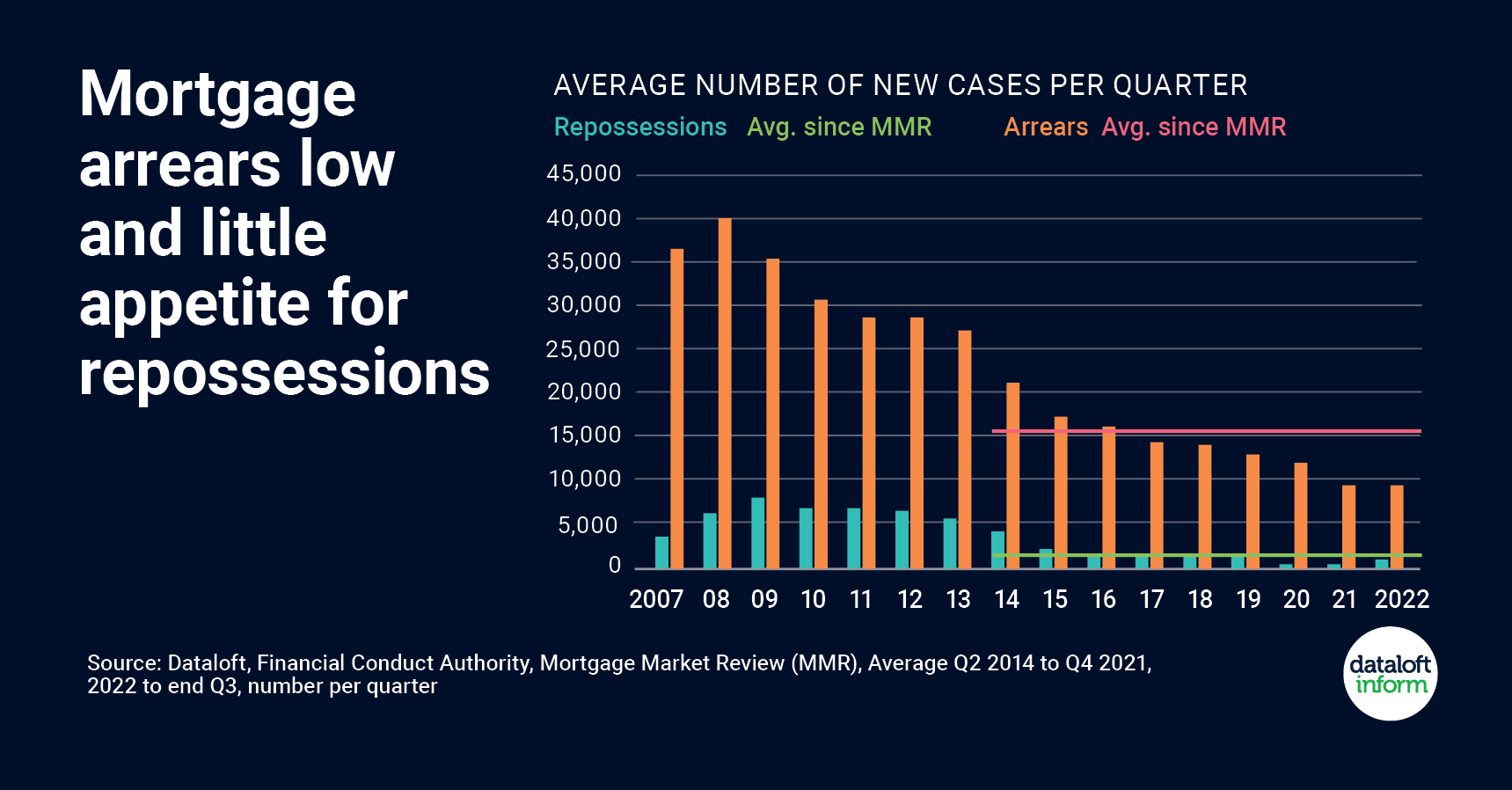

Mortgage arrears low and little appetite for repossessions.

BUBBLE ANALYSIS: Going down. In February, the Bank of England base rate was forecasted to rise to 4% during the year. However, we have witnessed the rate surpassing this figure in the second half of the year, reaching 5.25%. This increase has placed added pressure on households with mortgages. As reported in The Times on September 13, 2023, mortgage arrears balances have surged by 28.8% over the three months leading up to the end of June, totalling £16.9 billion. With the Bank of England suggesting that rates will remain elevated, we might see a rise in repossessions as we enter the beginning of 2024.

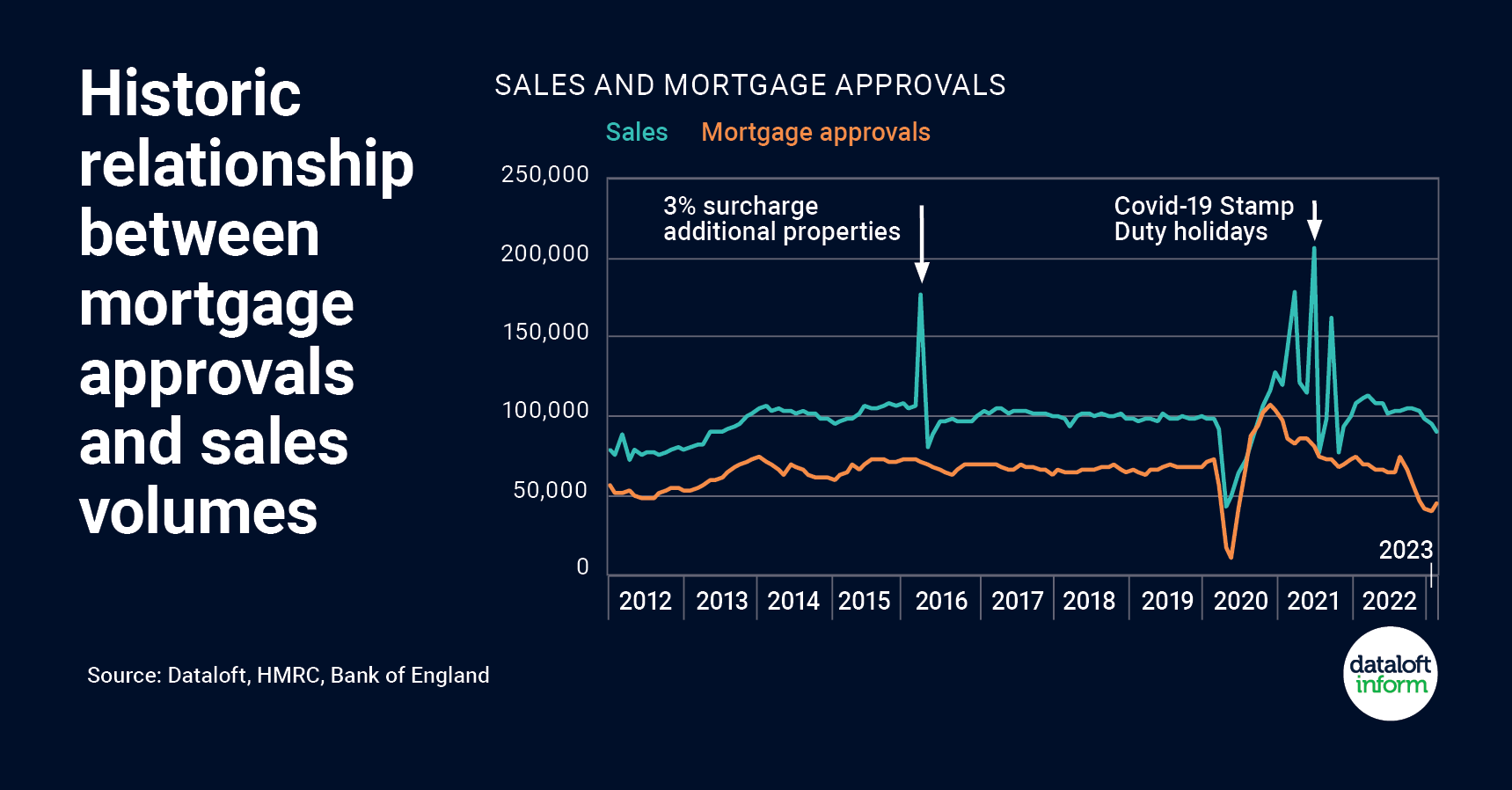

The continuing relationship between mortgage approvals and sales volumes.

BUBBLE ANALYSIS: Going down: Unsurprisingly the relationship between mortgage approvals and the volume of sales have always been linked. Mortgage approvals have improved since the beginning of 2023 but still remain slightly below typical levels. In the year up to July, approvals averaged 51,600 per month, which is 21% lower than the average for the seven years preceding the pandemic. Demand for homes is 34% lower than the average for the same period in the last five years (according to Hometrack).

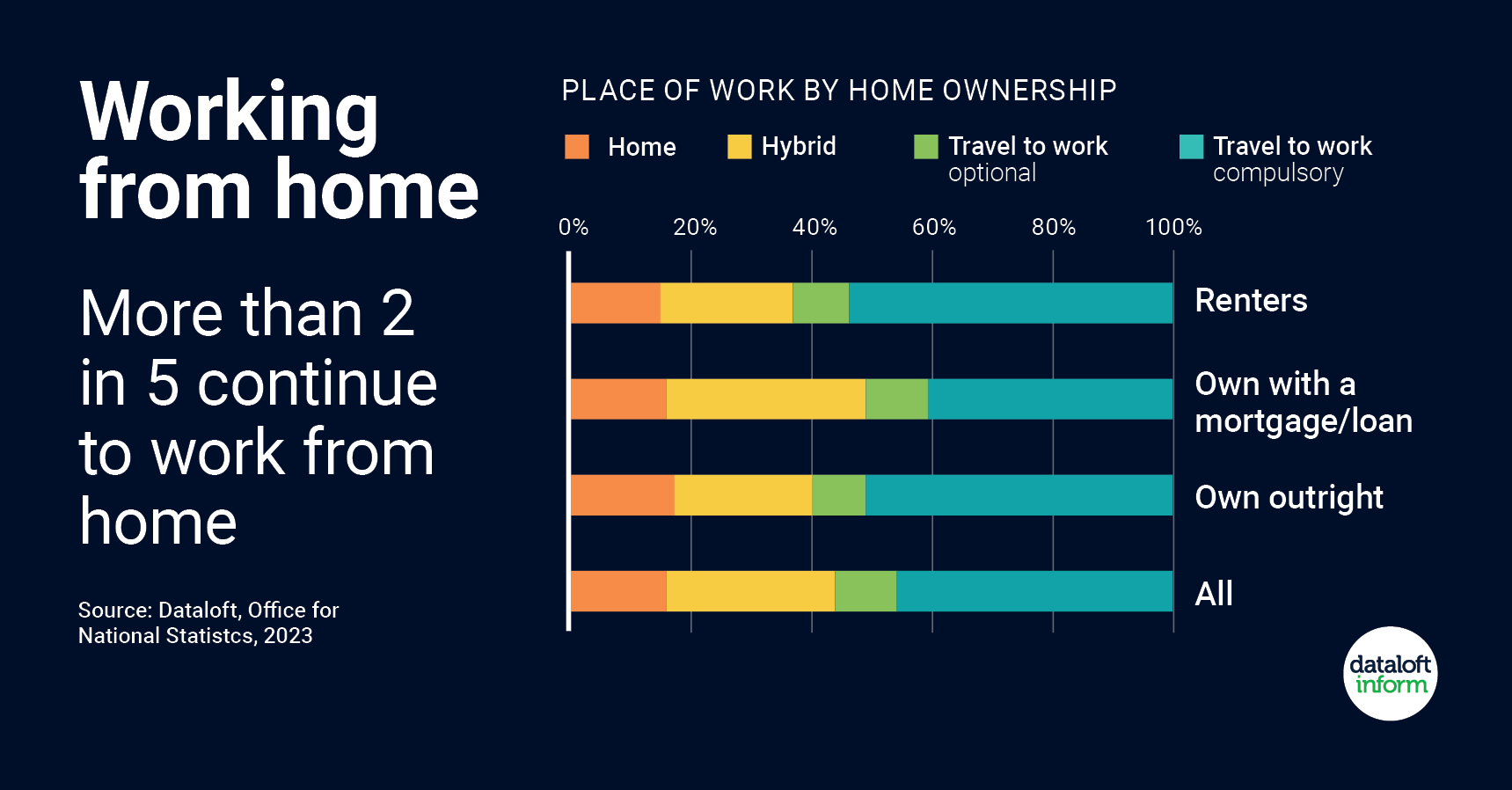

Are people still working from home?

BUBBLE ANALYSIS: Mixed: Covid-19 brought about a significant change in the way people work. They were no longer required to be in the office every day but could now work from home. Consequently, this meant people could move and live in different parts of the country without losing their jobs. This chart shows that, in general, people are continuing with this style of working even though major companies are requiring employees to be present in their office environments 2 to 3 times per week. This does mean we are witnessing an exodus of buyers who previously worked in London. However, they still feel confident about putting down roots in many different towns and cities around the UK.

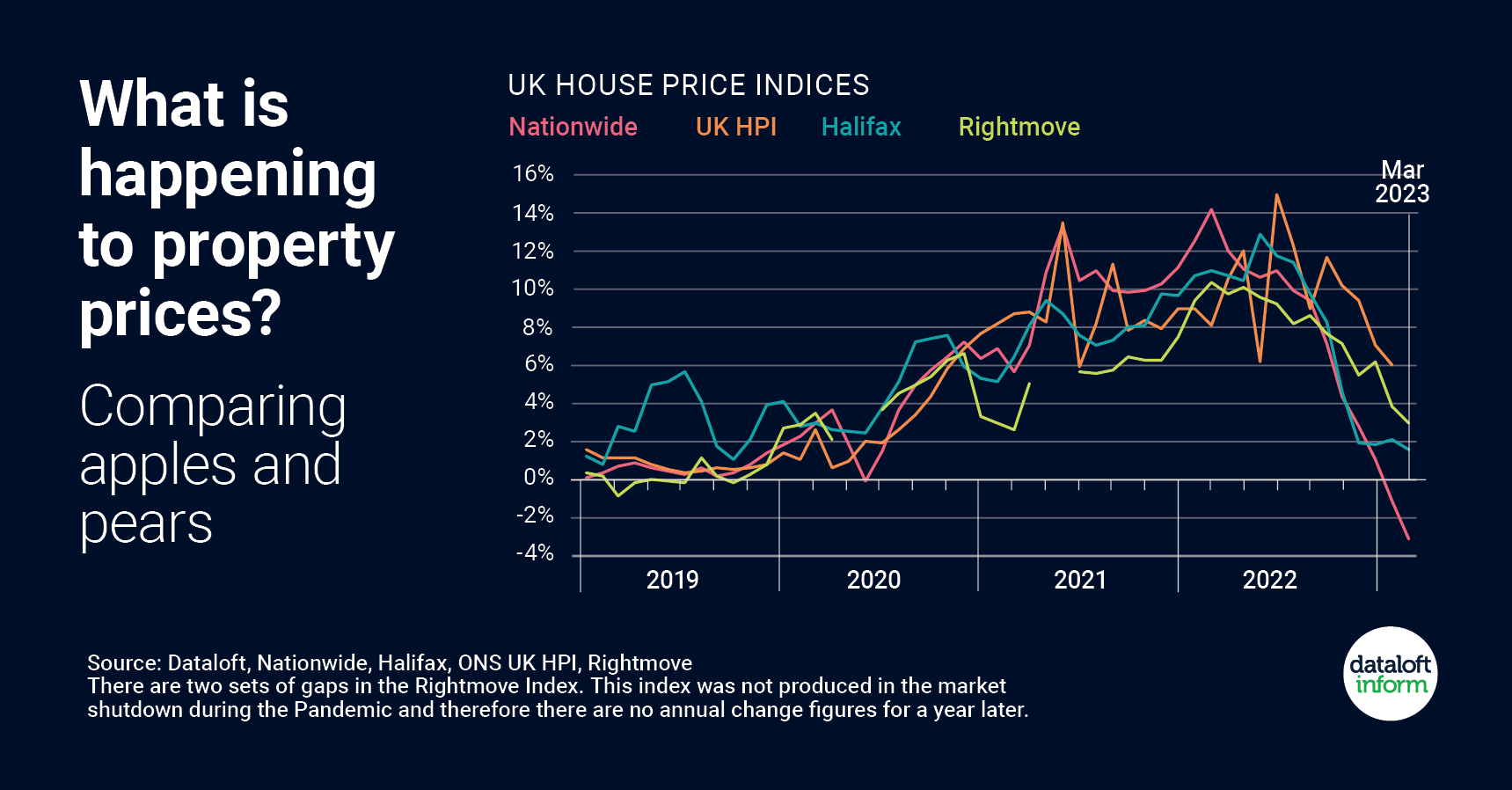

What is happening to property prices?

BUBBLE ANALYSIS: Going down: Due to the different indices using various ways of measuring property prices, the organisations featured in this chart have all come to slightly different conclusions. The one thing they do agree on is that the price trend is falling. We can see this in the current market with many properties reducing there prices before they receive viewings or offers. According to Savills’ research, they anticipate a reduction in residential property prices of between 9% and 11% locally by the end of 2023.

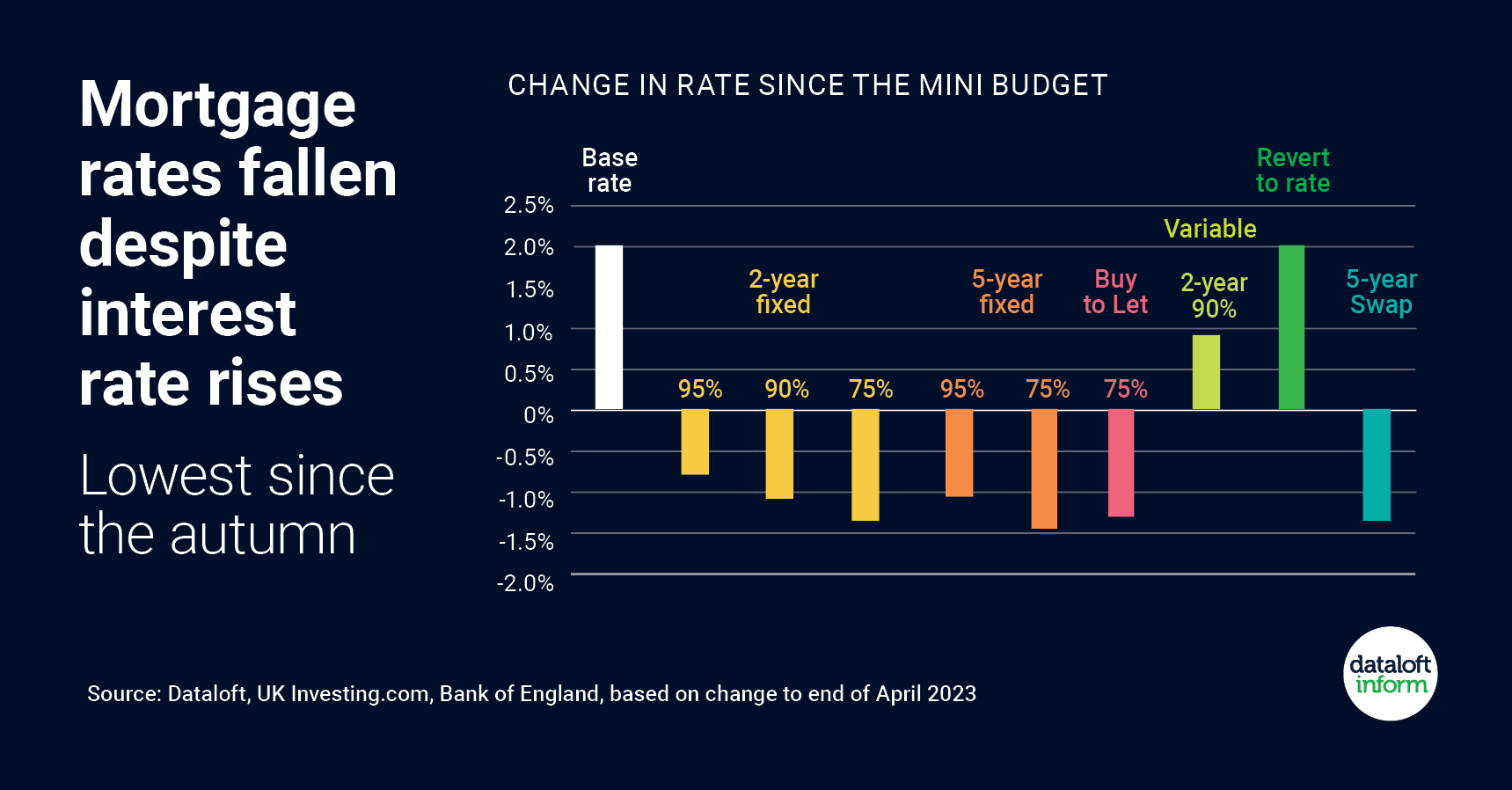

What about mortgage rates?

BUBBLE ANALYSIS: Going down: In May and June we saw mortgage rates come down slightly despite the continued rising level of interest rates. Lenders continue to align their variable rates with the Bank of England (BOE) rate hikes while adjusting their fixed rates in line with swap rates and long-term debt interest payments. This means that, at times, we are observing lender rates decrease even as the BOE rate increases. Even though we see these adjustments take place weekly, there does not seem to be light at the end of the 2023 tunnel where we may see what would be deemed affordable mortgage deals become available to the normal house buyer.

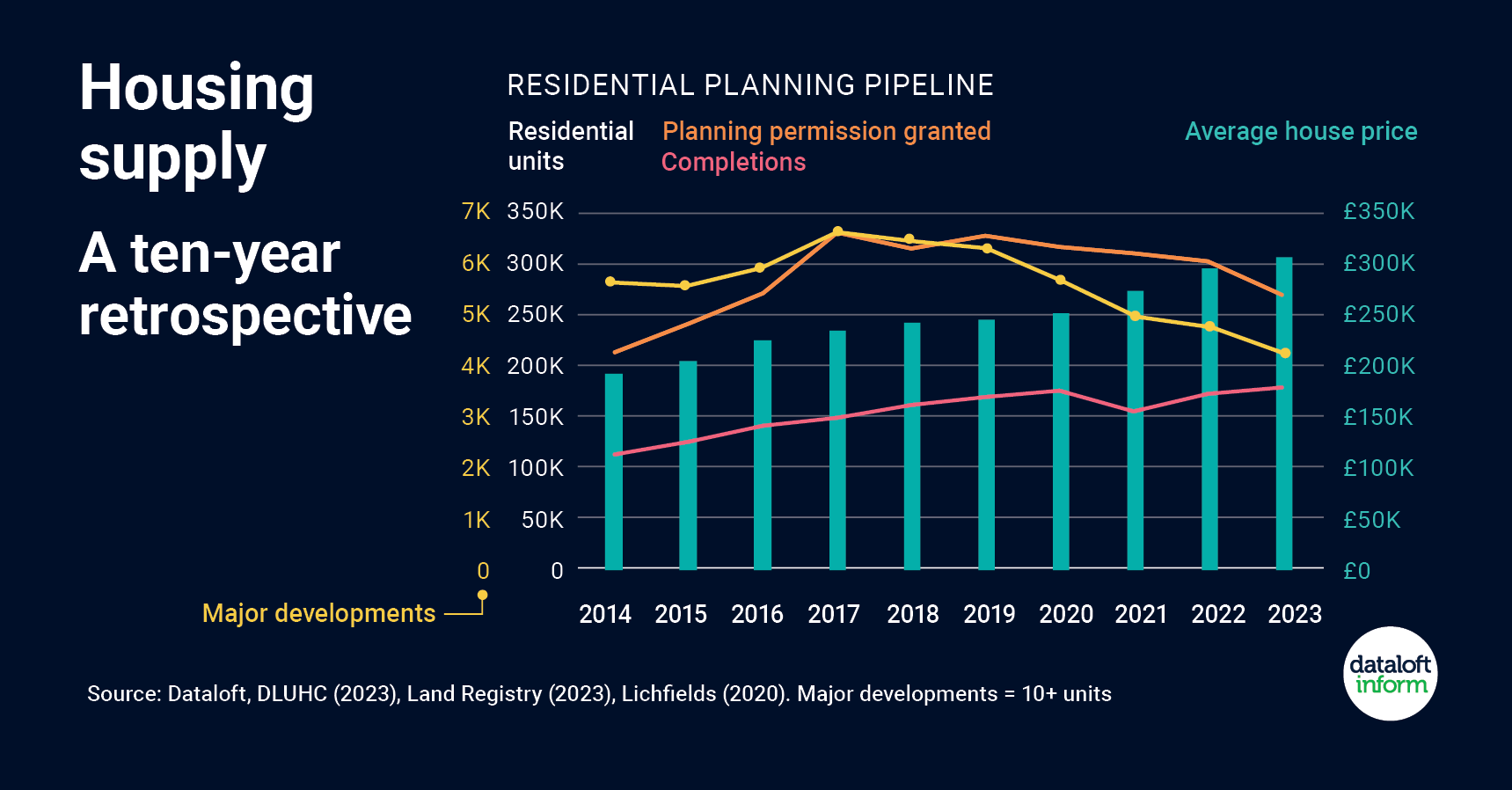

Taking a look at the housing supply over the last ten years.

BUBBLE ANALYSIS: Mixed. Compared to to the previous few years, we can see from the chart that there’s been an increase in the amount of housing being built (completions) by major builders however, this is likely to decrease through 2023/2024. The slowing build rate of new homes will mean that there is a decrease of homes available for sale which in turn will increase the average price of a new build property and prop-up / support the average house price in the UK.

Realistic pricing is essential!

BUBBLE ANALYSIS: Going down. As of 14th September, we saw 203 price reductions during the month in the Greater Peterborough area and over 2000 homes for sale that have been on the market for more than 12 weeks. The market has definitely changed from a seller’s market in 2022 to a buyer’s market in 2023.

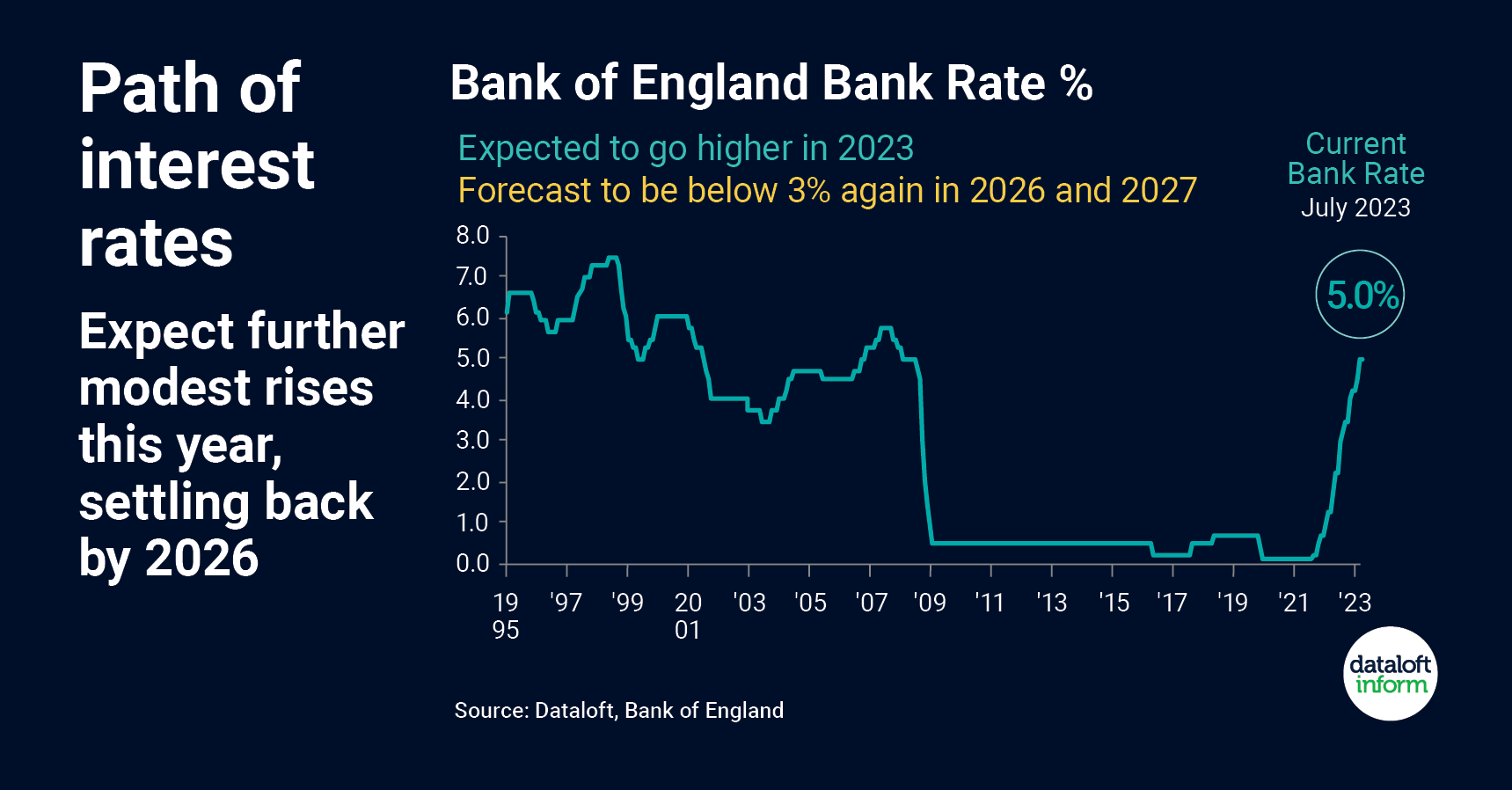

Interest Rates!

BUBBLE ANALYSIS: Going down. Interest rates remain high. As this forecast is being written, Bank of England interest rates currently stand at 5.25%. Outside influence may see the interest rates fall in 2024. These influences include the expectation that inflation will fall as we enter the new year and that we have an election process that will be expected to be in full swing in the autumn / winter of next year. Due to these influences we may see the Bank of England through the ‘Government’ decrease the Bank of England Base rate to ease the cost of living crises.

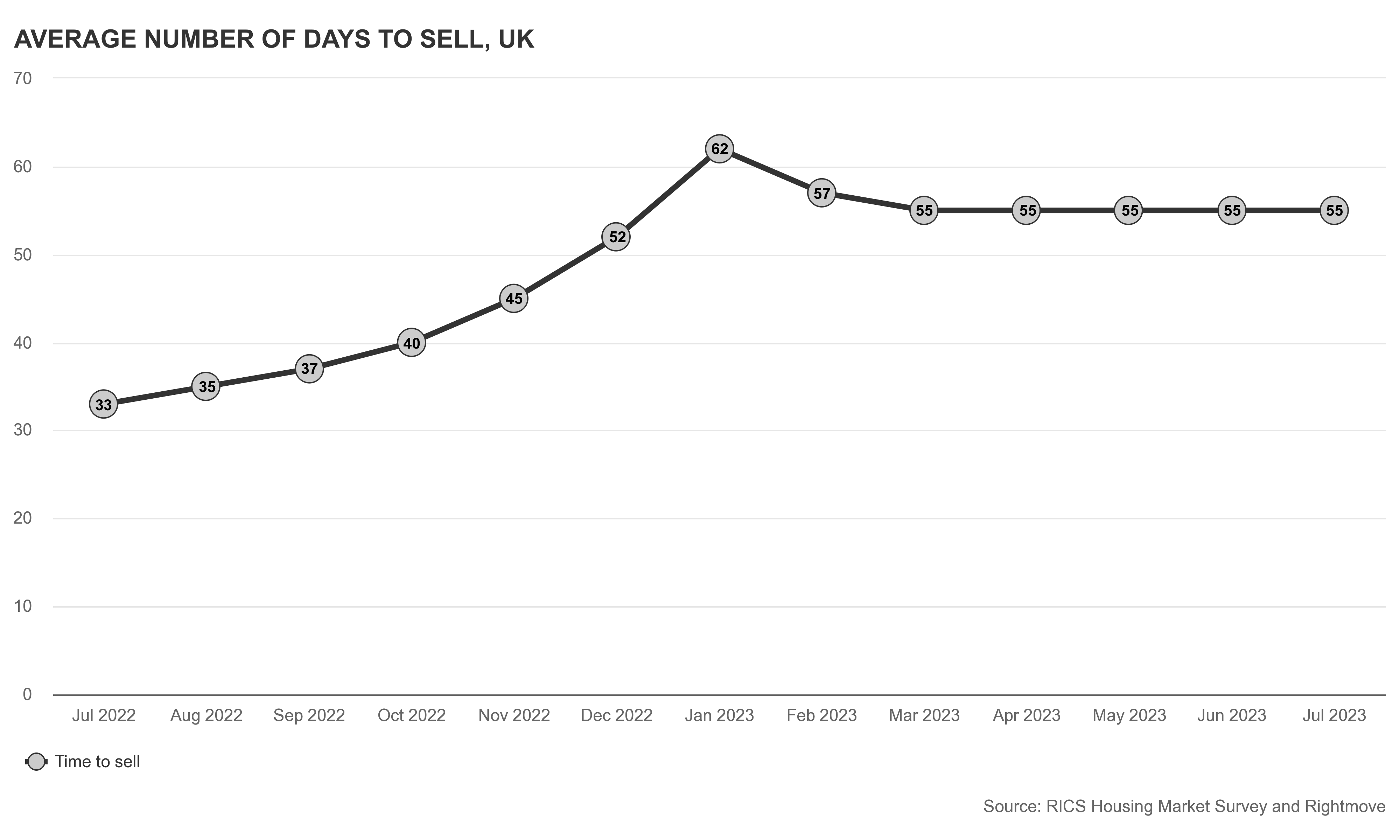

Average number of days to sell in the UK:

BUBBLE ANALYSIS: Steady. The average number of days to sell a home across the UK has decreased since January and has stabilised over the course of the year. Houses that have sold currently take an average of 55 days to do so across the UK. We expect this trend to continue throughout the rest of the year and into the start of 2024. This figure does not include homes that have not sold or homes that have been withdrawn from the market.

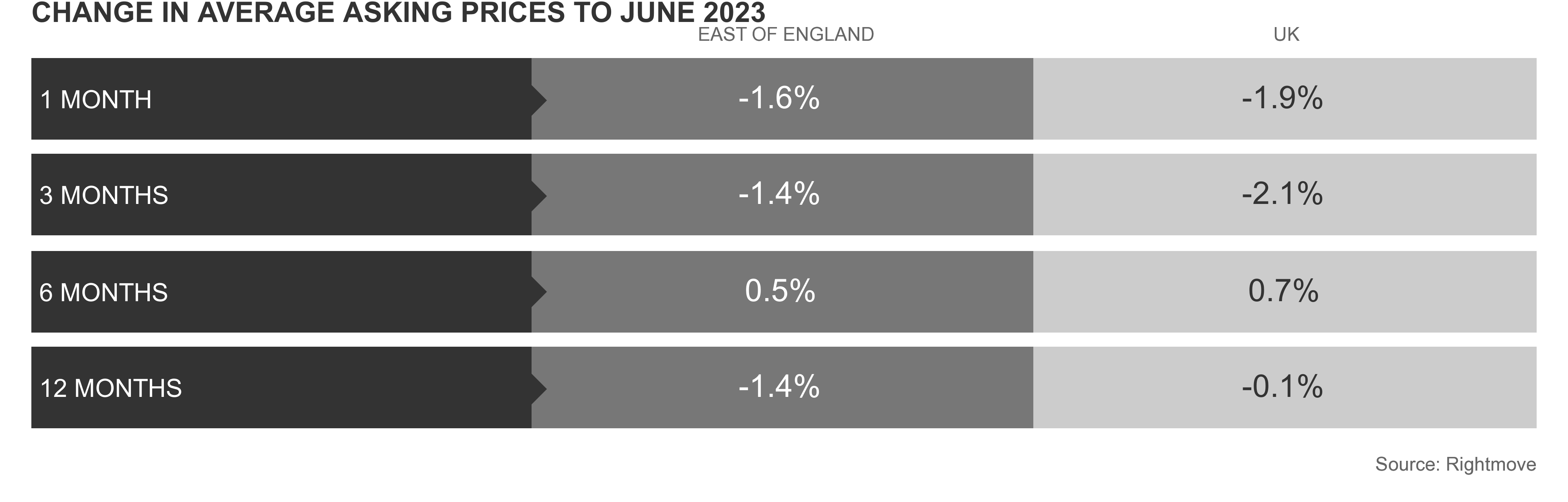

Average asking prices:

BUBBLE ANALYSIS: Trending Downward. Unfortunately, neither the annual growth nor the recent monthly growth in asking prices on Rightmove is positive. We anticipate this trend to continue into early 2024. Sellers are now recognising the buyer’s market, and frequent price reductions/corrections in marketing prices are becoming evident in the Greater Peterborough area.

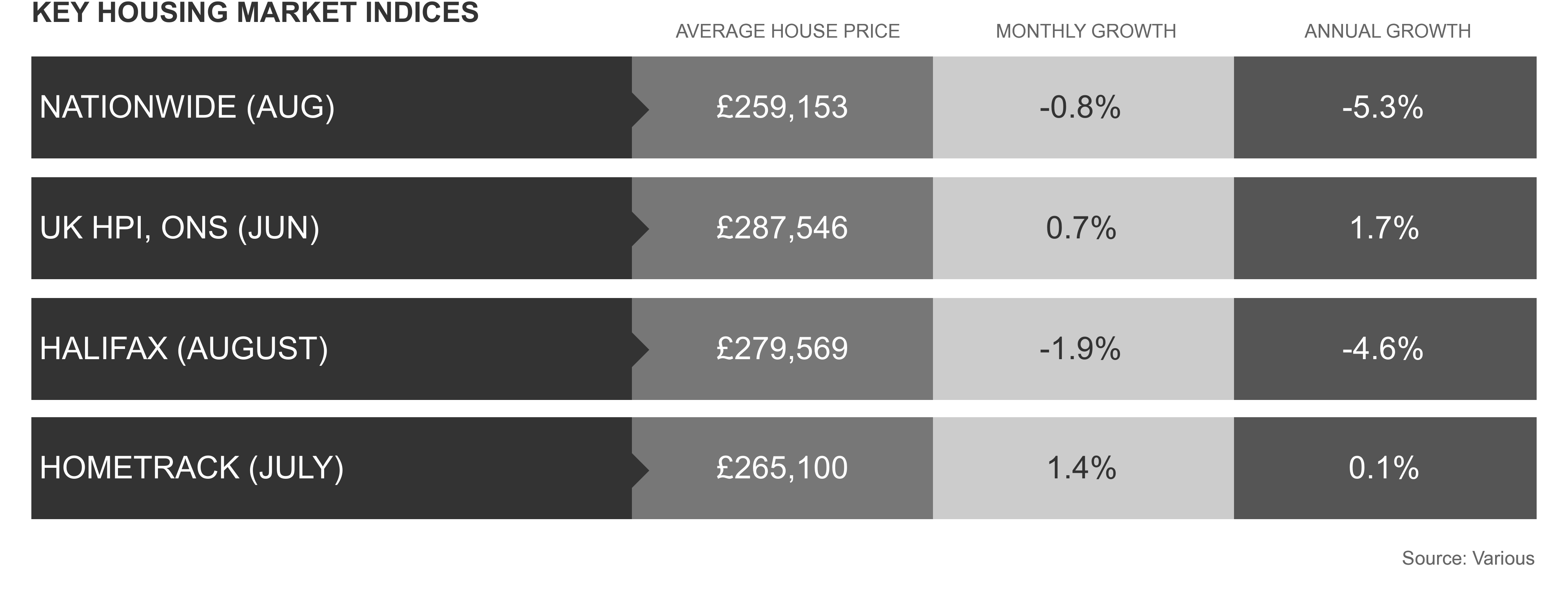

Key housing market indices:

BUBBLE ANALYSIS: Trending Downward. The ongoing cost of living crisis is now starting to manifest in historical data analysis, where indices are declining on a monthly basis. There is a noticeable North/South divide, with the southern area of the country experiencing a downturn, while some northern areas are seeing slight gains or a levelling off of property values.

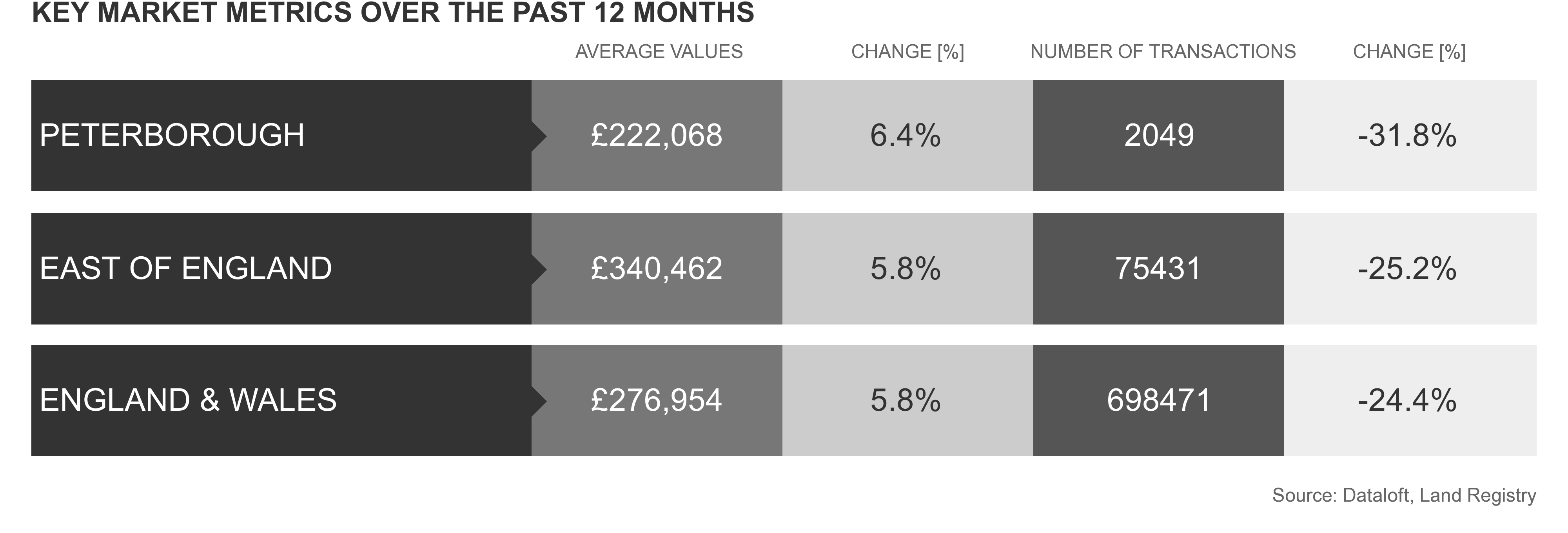

LOCAL MARKET PETERBOROUGH

BUBBLE ANALYSIS: Trending Downward. Locally, we’ve witnessed a significant decrease in the number of transactions occurring over the last 12 months. The average property values remain relatively strong over a twelve-month period, largely due to the market being much more stable and stronger at the beginning of this period. There are far fewer buyers in the market currently, with a plethora of homes to choose from for those who are looking. Since the start of the year, there have been 6,980 properties listed on Rightmove in the Greater Peterborough area, and of those, only 2,172 have sold (according to Rightmove). This situation will persist until mortgage rates become more affordable and more potential buyers enter the market.

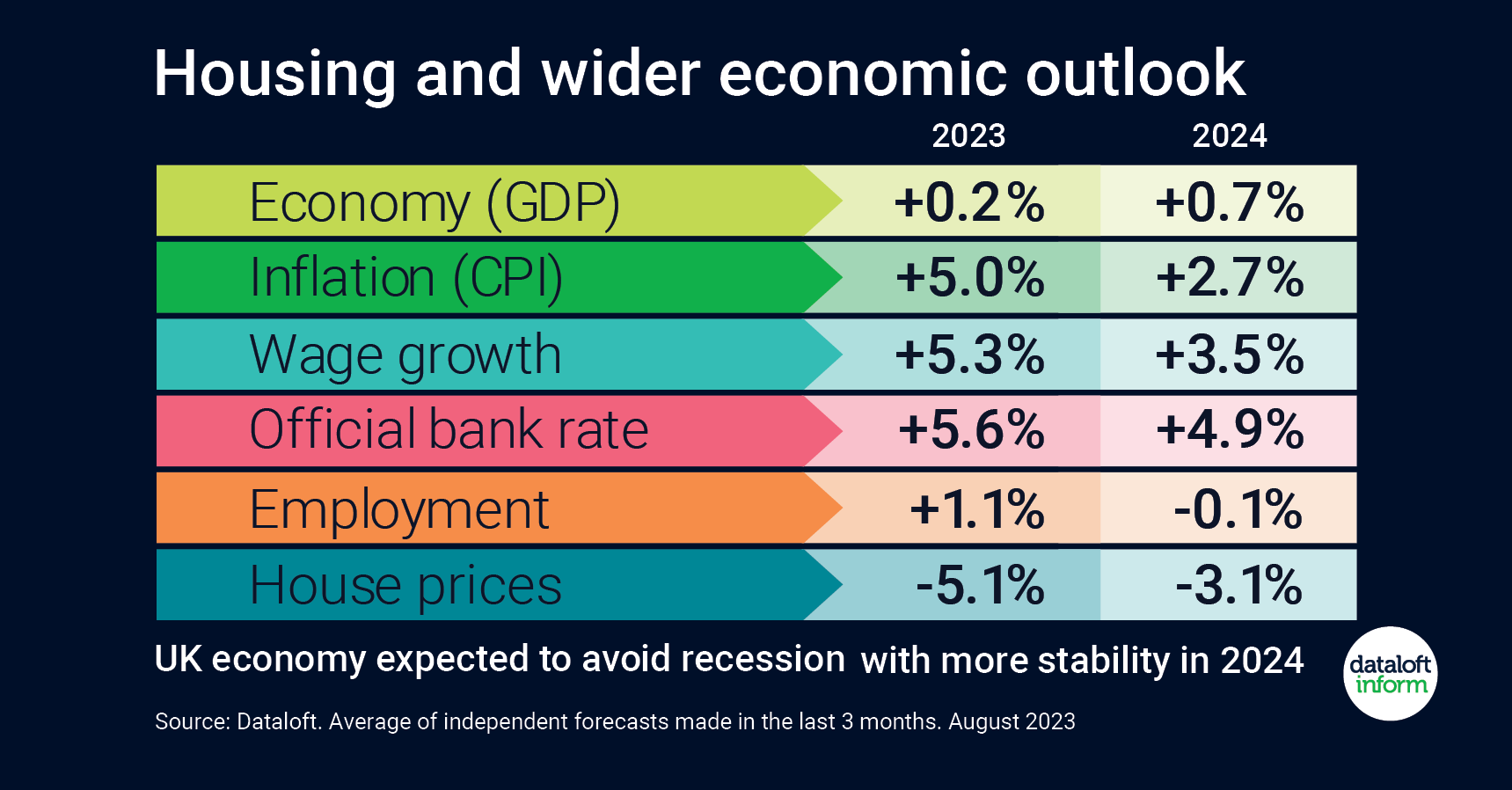

Housing and wider economic outlook!

BUBBLE ANALYSIS: Nationally, we’ve examined the implications of the dramatic rise in mortgage rates and what we can anticipate as we head into the end of 2023 and the beginning of 2024. Current market conditions are challenging for everyone, and we do not expect this to change anytime soon. House prices will need to continue to fall if mortgage rates remain at their current levels, as affordability for the vast majority of people is nearing an impossible cost for larger homes.

Locally in Peterborough, we remain an attractive option for buyers currently living in London or the A1 corridor. With our lower cost of living, it is feasible to travel into the capital once or twice a week and work from home, thanks to the availability of high-speed broadband. Due to rising costs, we are witnessing a large number of people leaving London and the A1 corridor because living in these locations has become too expensive. Here in Peterborough, we must take advantage of this migration, which will enable sellers to move on to the next chapter in their lives.