I’m forever blowing bubbles,

Pretty bubbles in the air,

They fly so high, nearly reach the sky,

Then like my dreams they fade and die.

A song written in 1919 in the States and made famous in the music halls of Britain in the 1920s. Football fans will instantly relate the tune to West Ham United however the song could have also been adopted by the UK press when discussing the housing market cycles.

So where are we in the cycle of housing bubbles, is the bubble rising, fading or ready to burst?

Let’s look at the individual areas effecting our property market in Peterborough from June 2023 onward to understand what 2024 might bring:

UK Housing Market Adjusts to New Realities (June 2023)

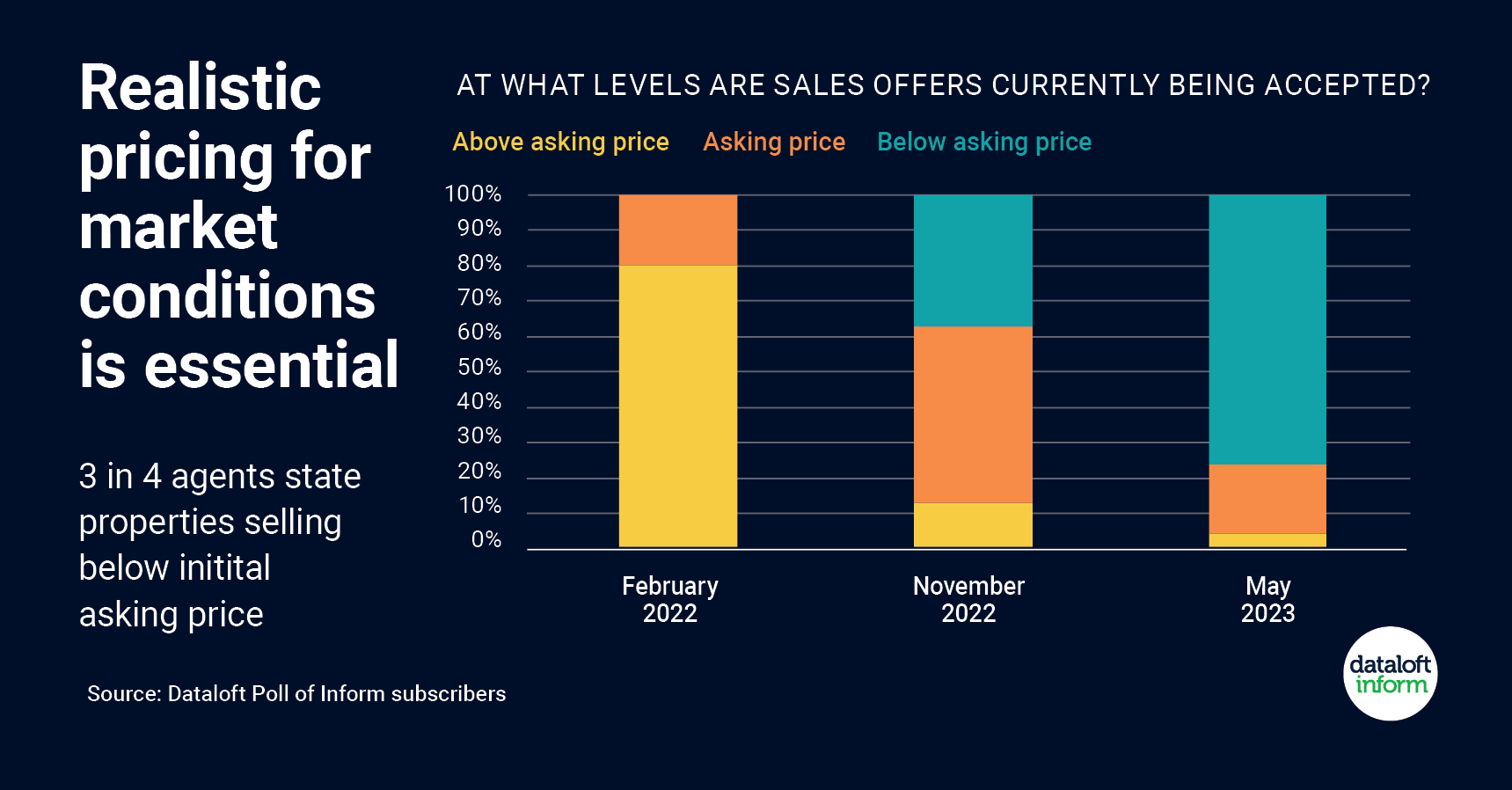

The latest Dataloft Inform poll reveals a significant shift in the UK housing market, with over 75% of agents reporting sales below initial asking prices. This downturn marks a departure from the enthusiastic pricing of recent times. Despite Rightmove noting a 1.8% rise in average asking prices between April and May, the real-world scenario is less rosy. More than half of the agents have observed properties selling at an average reduction of up to 5%, and nearly a quarter report even larger decreases.

This cooling trend contrasts starkly with the market’s buoyancy in early 2022, where many properties sold above asking prices, and as recently as November, half of the properties were achieving their asking prices.

Verdict: Cautious Downturn (going down)

These indicators suggest the UK housing market is experiencing a cautious downturn. The gap between asking and selling prices reflects a market recalibrating to more realistic valuations, moving away from the optimism seen in the preceding months. This shift points towards a more tempered, perhaps more sustainable market trajectory.

Rising Interest Rates Stir Uncertainty in UK Housing Market (July 2023)

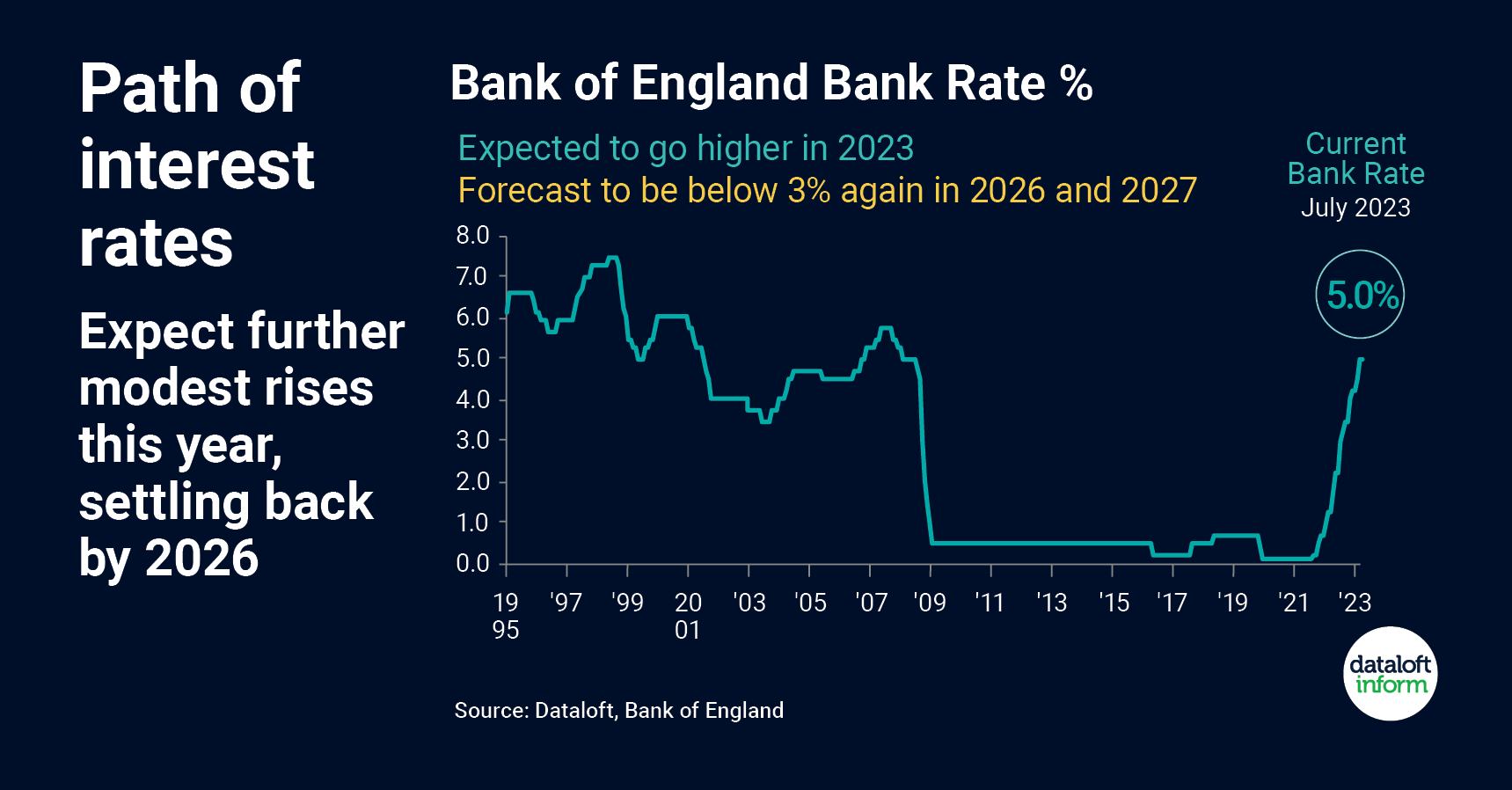

The UK’s recent sharp increase in interest rates, with the Bank Rate now at 5%, is causing unease among borrowers, signalling potential shifts in the housing market. Forecasts suggest a short-term rise to an average of 5.6% by year-end, adding pressure on mortgage holders and potential buyers. However, this upward trend is not expected to be permanent. Projections indicate a decrease to below 3% in 2026 and 2027, offering a glimmer of hope for long-term market stability.

This steep hike in rates mirrors the dramatic fall experienced during the Global Financial Crisis, highlighting the economic volatility affecting the housing sector. The latest inflation data from June shows signs of improvement, which could positively influence the long-term interest rate landscape.

Verdict: Mixed Outlook

Given these dynamics, the UK housing market’s future appears mixed. While short-term challenges due to rising interest rates are evident, the anticipated long-term reduction in rates and improving inflation figures suggest potential stabilisation in the coming years. This balance of immediate pressures and future prospects points to a period of uncertainty followed by gradual recovery.

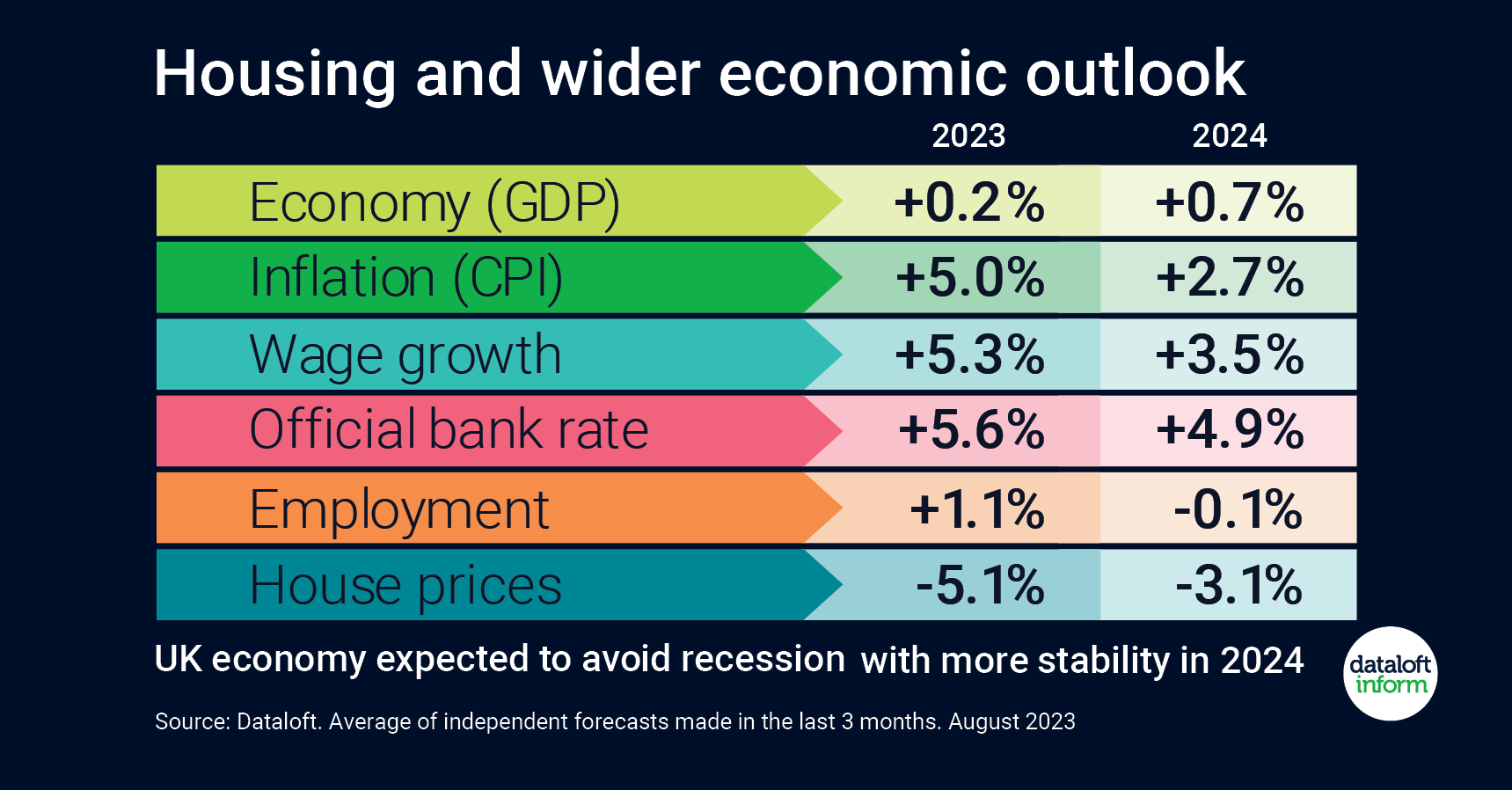

UK Housing Market: Anticipating Stability Amid Economic Shifts (August 2023)

The UK’s economic indicators offer mixed signals as we head into 2024. The Bank of England’s interest rate, after 14 consecutive hikes reaching 5.25% in August, is expected to plateau, signalling a possible easing of inflationary pressures. Despite inflation outpacing the target, wage growth and employment show positive trends.

For the housing market, a period of price adjustments appears inevitable. However, with the broader economy forecasted to skirt a recession and political winds blowing towards potential homeowner support—especially for first-time buyers—the market may find firmer ground in 2024.

Verdict: Cautiously Upward (going up)

The synthesis of economic forecasts suggests a cautiously upward trend for the UK housing market. Prices may wobble as the market finds equilibrium, but the avoidance of recession coupled with supportive fiscal policies could bolster market confidence, offering a stable, if not entirely robust, outlook for the near future.

UK Housing Market: A Glimmer of Recovery Amidst Economic Challenges (September 2023)

The UK housing market’s pulse can be gauged by monitoring mortgage approvals, a leading indicator preceding residential sales trends by about three months. Current data shows a rise in approvals since early 2023, albeit still 21% below the pre-pandemic seven-year average. This uptick, following a significant dip in December 2022 and January 2023, suggests a cautious resurgence in market activity.

The drop in approvals at the end of last year was a reaction to the uncertainty surrounding inflation and interest rates. However, the situation is showing signs of improvement. Recent inflation data brings a ray of hope, and interest rates are expected to peak this year, with a forecasted decline in 2024.

Verdict: Cautiously Optimistic (going up)

The recovery in mortgage approvals, coupled with positive inflation trends and anticipated easing of interest rates, points towards a cautiously optimistic outlook for the UK housing market. The revival in approvals indicates the first shoots of recovery, suggesting that the market might gradually regain its footing after a tumultuous period.

UK Housing Market Sees Dip in Sales, But Prices Remain Steady (September 2023)

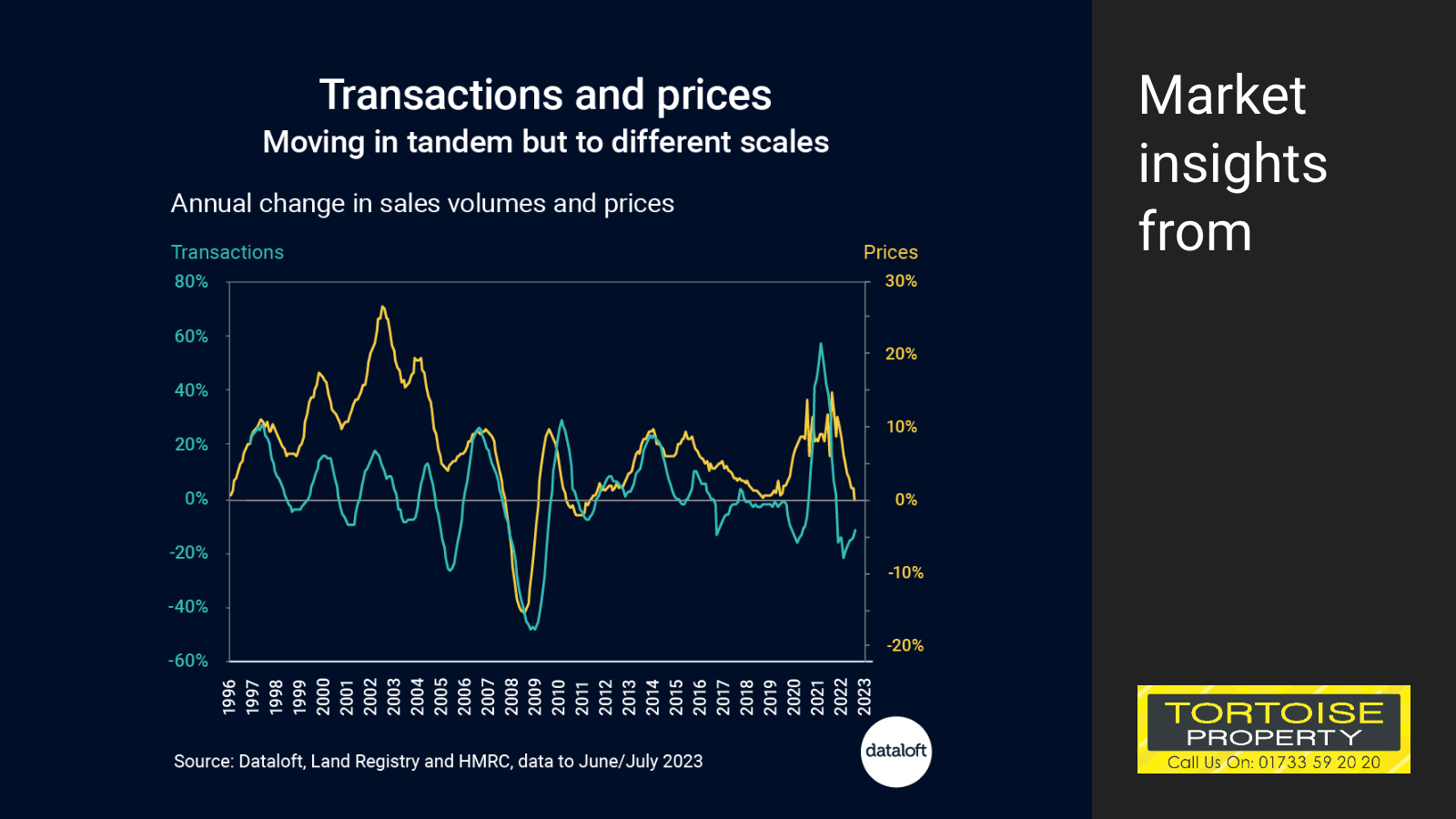

The UK housing landscape is undergoing a notable shift. In the year ending July, residential sales in England and Wales reached just over one million, marking an 11.4% decrease compared to the previous year. This downturn follows the unusually high transaction volumes experienced during the pandemic. However, when compared to pre-pandemic levels, the current figures are only 7.8% lower than the five-year average leading up to 2019.

Historical trends reveal an interesting pattern: while sale volumes and prices typically move together through market cycles, their scales differ. For instance, during the last housing market downturn, the most significant annual fall in sale volumes was 47.6% (year to February 2009), yet the sharpest drop in prices was notably less severe at 15.4% (year to end March 2009).

Verdict: Resilient Pricing Amidst Lower Sales Volume (mixed)

This data suggests that although the UK housing market is experiencing a reduction in sales volume, it doesn’t necessarily equate to a parallel fall in property prices. The market appears to be showing resilience in terms of pricing, even as the number of transactions moderates from the pandemic-induced highs.

UK Housing Market: Cautious Optimism Amid Interest Rate and Inflation Dynamics (October 2023)

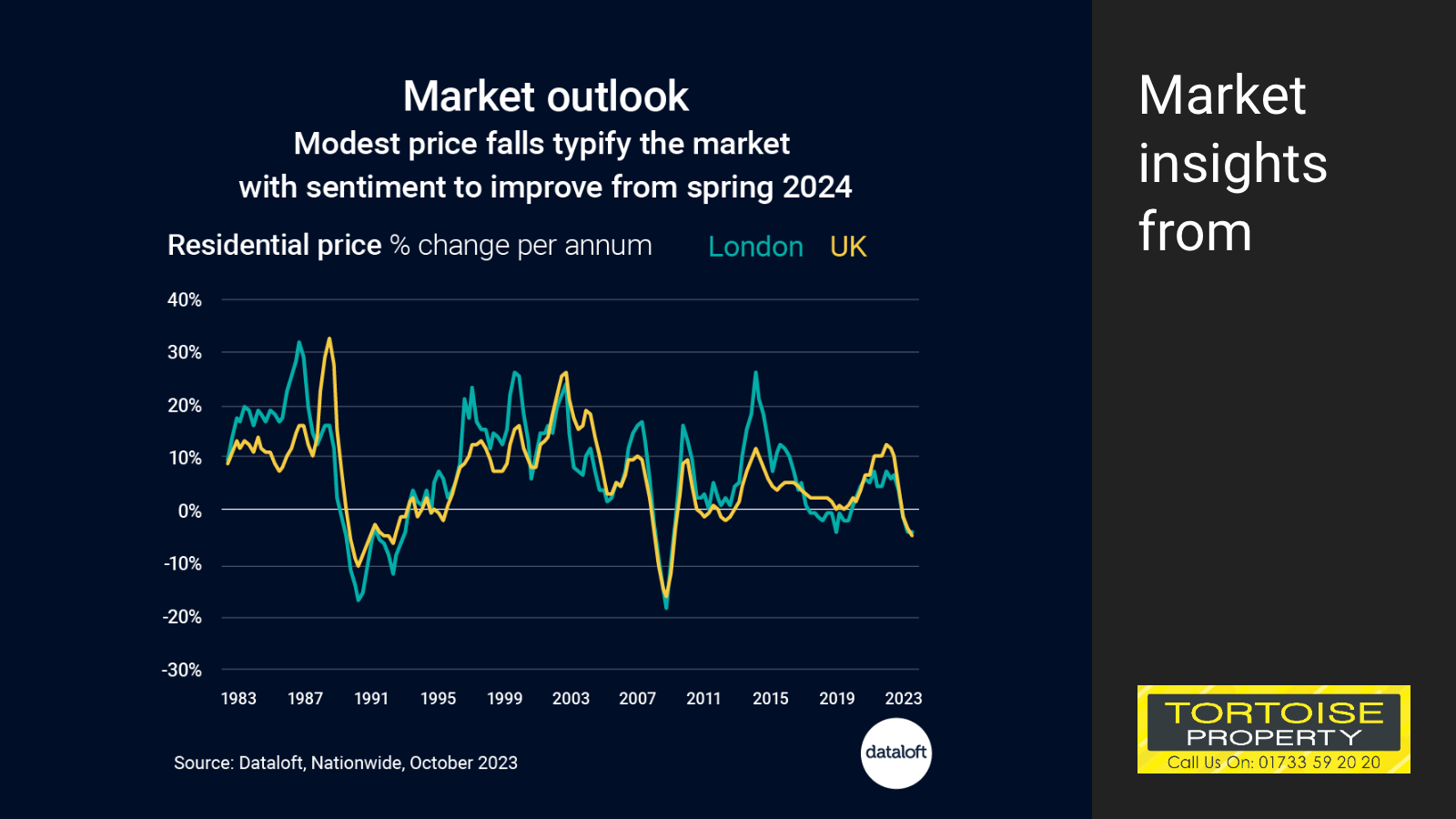

The UK housing market is on the verge of change. As interest rates approach their peak, the latter part of 2023 is expected to maintain low sale volumes and exhibit some price volatility. However, spring 2024 is anticipated to bring an upturn in the market. With one more 25 basis point rise in the Bank Rate on the horizon, stability seems within reach. Yet, any additional rate hikes or a reversal in the current downward inflation trend could jeopardise this fragile recovery.

The tumultuous period in Q3 2022, marked by rapid interest rate changes, led to sharp price drops in the subsequent quarters. But since then, the market has shown signs of stabilisation. In fact, current property prices have edged above those recorded at the end of Q1 2023, indicating a slow yet steady rebound.

Verdict: Guarded Upturn (going up)

This analysis points towards a cautiously optimistic outlook for the UK housing market. While short-term challenges persist, the overall trend suggests a gradual movement towards stabilisation and growth, albeit contingent on maintaining a balanced approach to interest rates and inflation.

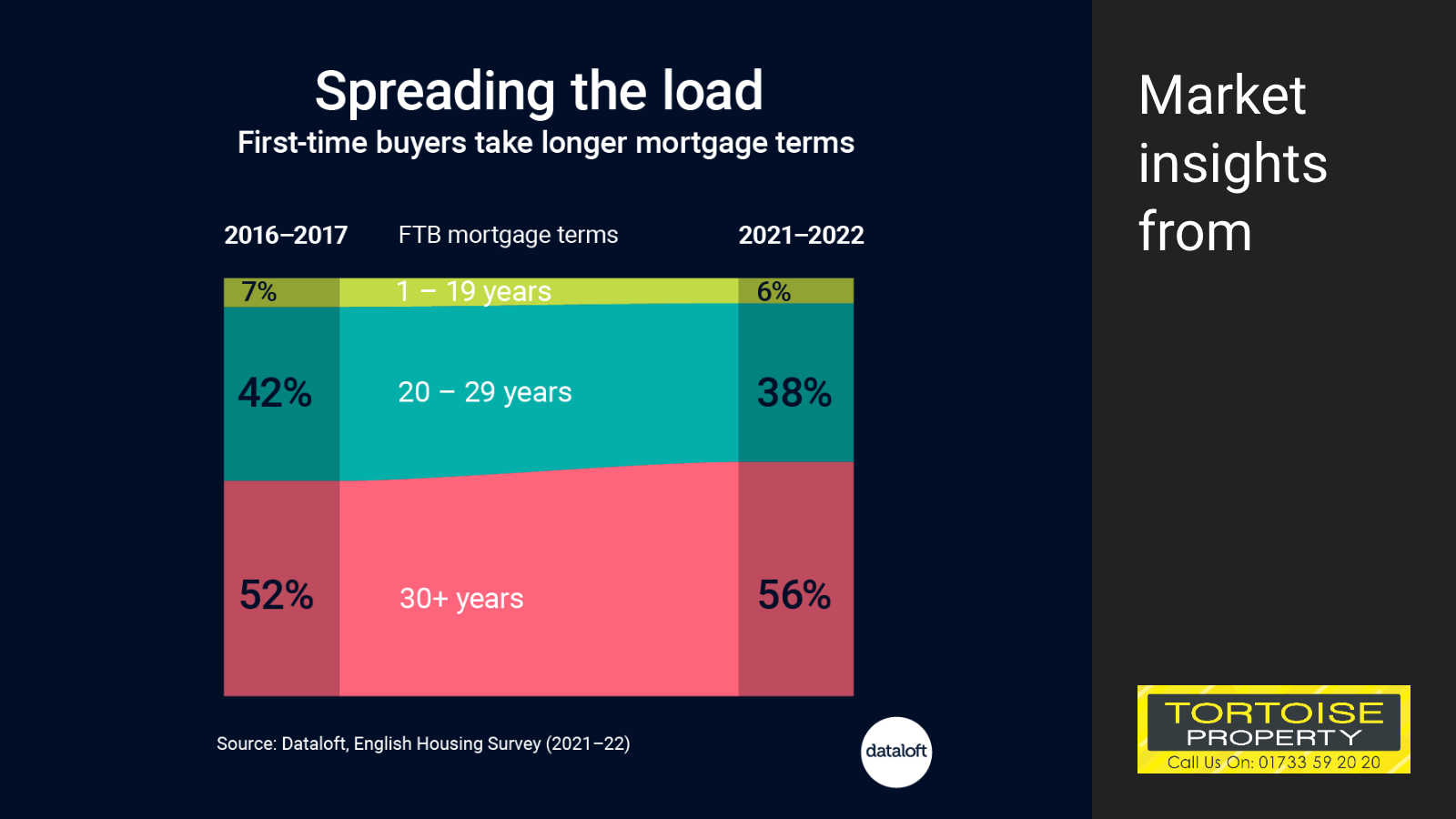

Adapting to Change: First-Time Buyers Navigate UK’s Rising Housing Costs (October 2023)

In the face of escalating housing costs, UK first-time buyers are employing creative strategies to afford their initial step onto the property ladder. Data from 2021–2022 indicates a significant shift towards longer mortgage terms, with over half opting for loans extending 30 years or more, a stark increase from just a third in 2008–2009.

The remaining buyers are divided between the more traditional repayment period of 20–29 years (38%) and a minority (6%) securing terms shorter than 20 years. This trend reflects the growing challenge of affordability, as evidenced by the rise in average monthly mortgage payments for first-time buyers, now £1,194, up from £1,048 last year.

Verdict: Resilient but Strained (mixed)

This shift towards longer mortgage terms among first-time buyers suggests a resilient yet strained response to the UK’s rising housing costs. While these strategies demonstrate adaptability, they also highlight the increasing financial pressures faced by new entrants into the housing market. The situation presents a mixed outlook: a market that is still accessible but requires greater financial stretching for new homeowners.

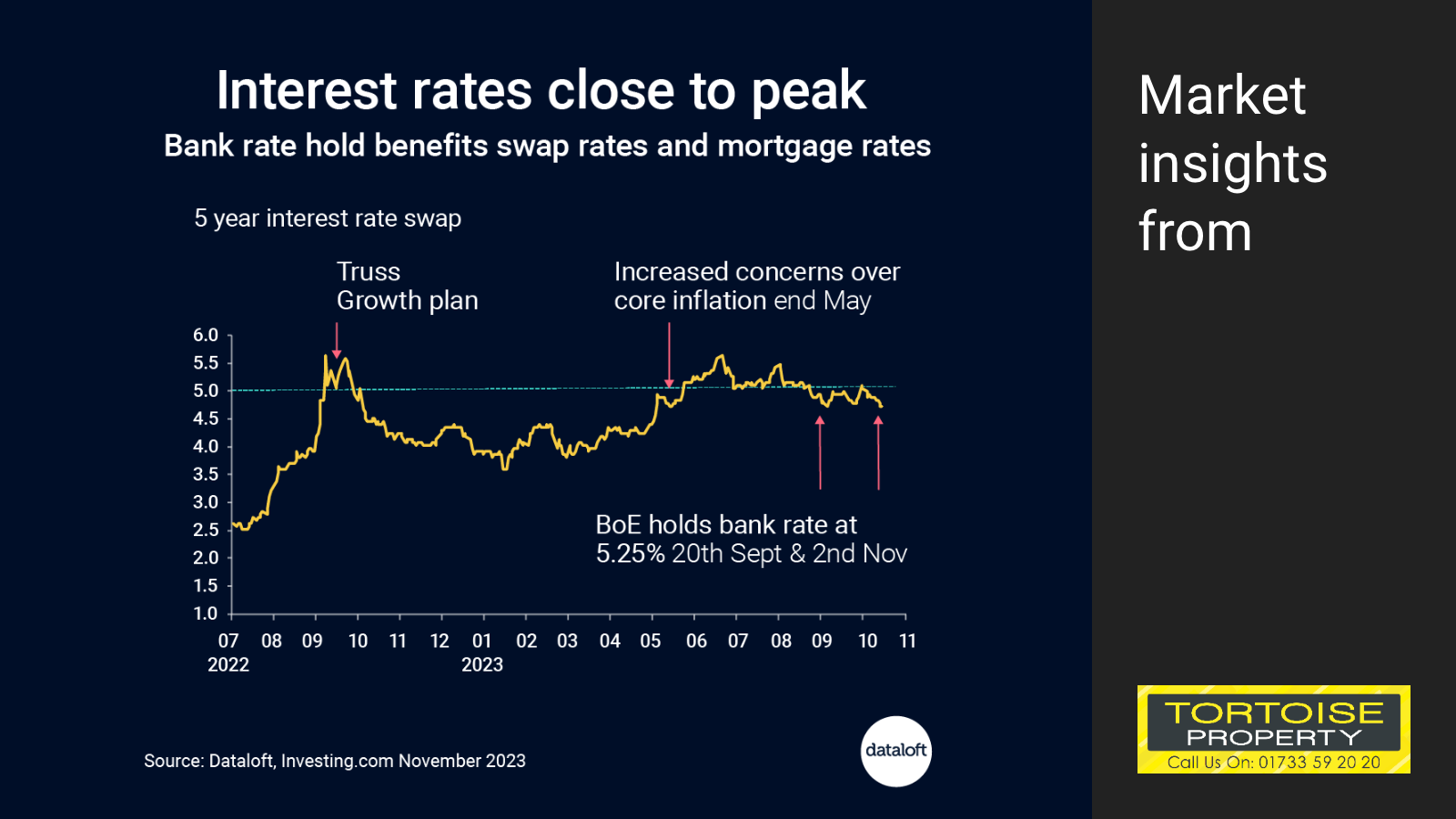

UK Housing Market Braces for Interest Rate Stabilisation (November 2023)

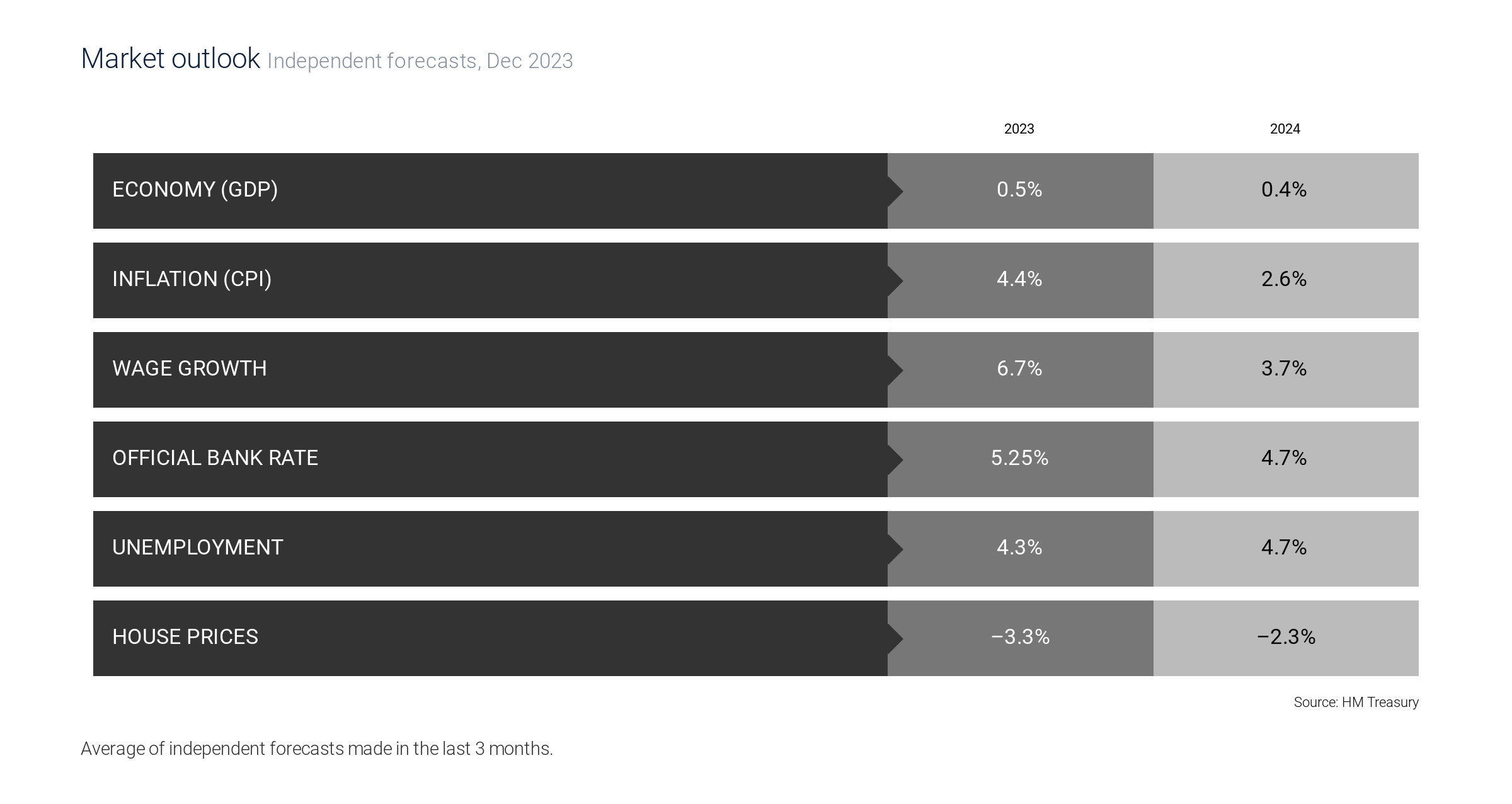

In their November 2023 meeting, the Bank of England maintained the bank rate at 5.25%, a crucial factor influencing the residential market. HM Treasury’s consensus forecasts suggest that interest rates may have reached their peak, with a slight increase to 5.3% expected by the end of 2023, followed by a decrease to 4.7% by the end of 2024.

The 5-year swap rates, indicators of mortgage costs, have responded positively to the Bank’s decision, hitting their lowest point since May. This is a hopeful sign for lenders and borrowers alike. Despite the market still adapting to the higher interest rates, resulting in persistently low mortgage approvals, a change in sentiment is anticipated from Spring 2024, as the peak in interest rates suggests a plateau or a downward trend.

Verdict: Tentative Recovery on the Horizon (going up)

The UK housing market appears poised for a gradual recovery. The stabilisation or reduction in interest rates expected in the near future is likely to inject some optimism into the market. While immediate challenges remain, the outlook for 2024 hints at improving conditions, fostering a cautiously optimistic view for the housing sector’s fortunes.

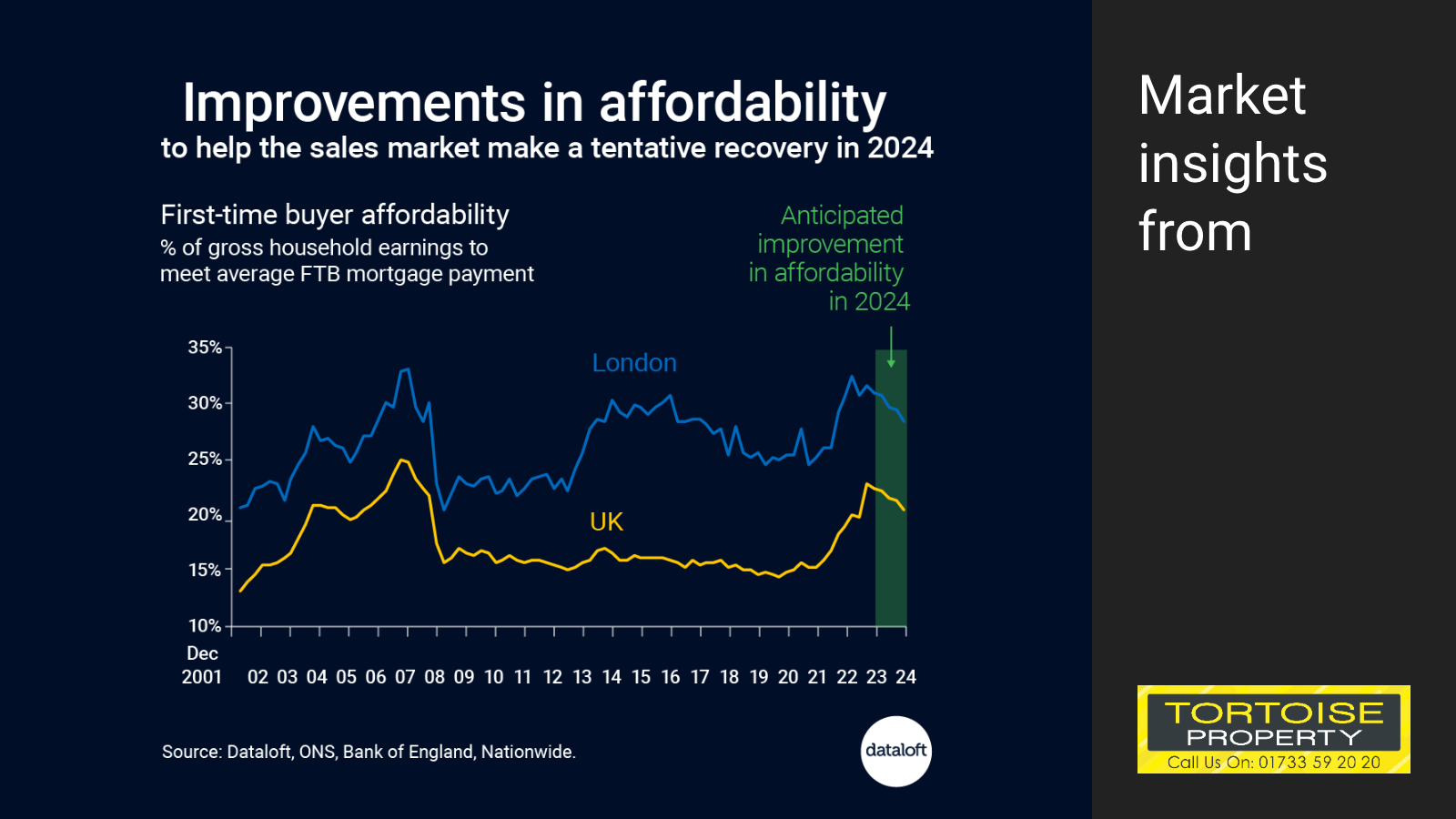

UK Housing Market Eyes Affordability for Recovery Hopes (December 2023)

The UK housing market’s future hinges on affordability, a key indicator of market health and buyer confidence. A closer look at current trends suggests a potential for recovery in 2024, driven primarily by the expectation of improved mortgage rates. The end of November saw 5-year swap rates dip to 4.4%, a positive sign for future mortgage rate reductions.

Affordability, in this context, is measured by the portion of household earnings needed to meet mortgage payments. Current projections include a forecast of average earnings growth of 3.4% for 2024, an average new lending rate improvement to 4.5% by the year’s end, and a stabilisation of first-time buyer (FTB) prices after a predicted 1% fall in the remaining quarter of 2023.

Verdict: Cautious optimism for 2024 (going up)

The convergence of these factors – lower swap rates, expected earnings growth, and stabilising property prices – paints a cautiously optimistic picture for the UK housing market. While immediate challenges persist, the improving affordability scenario points towards a gradual recovery in buyer confidence and market activity in the coming year.

Resilient Rental Sector to Lead UK Housing Market Recovery Post (January 2024)

The UK housing market is on the brink of a cautious resurgence. Sales prices, expected to dip by -2.1% in 2024, are forecasted to rally from 2025, marking an upswing with a near 3% increase by 2028. Rental prices are predicted to eclipse sales in growth each subsequent year, highlighting a robust rental market. Sources such as Dataloft and HM Treasury contribute to this composite forecast, showcasing a rental market that continues to thrive and command investor interest.

Verdict: Struggling sales and robust rentals (mixed)

With a slight dip in 2024 but a rebound in the following years, the UK housing market is set for a mixed but optimistic future. The robust rental sector underpins a gradual but positive shift in the market, signalling an uptick in the market’s fortunes from 2025 onwards.

Peterborough Housing Market: A Look at the Numbers Amidst Economic Changes

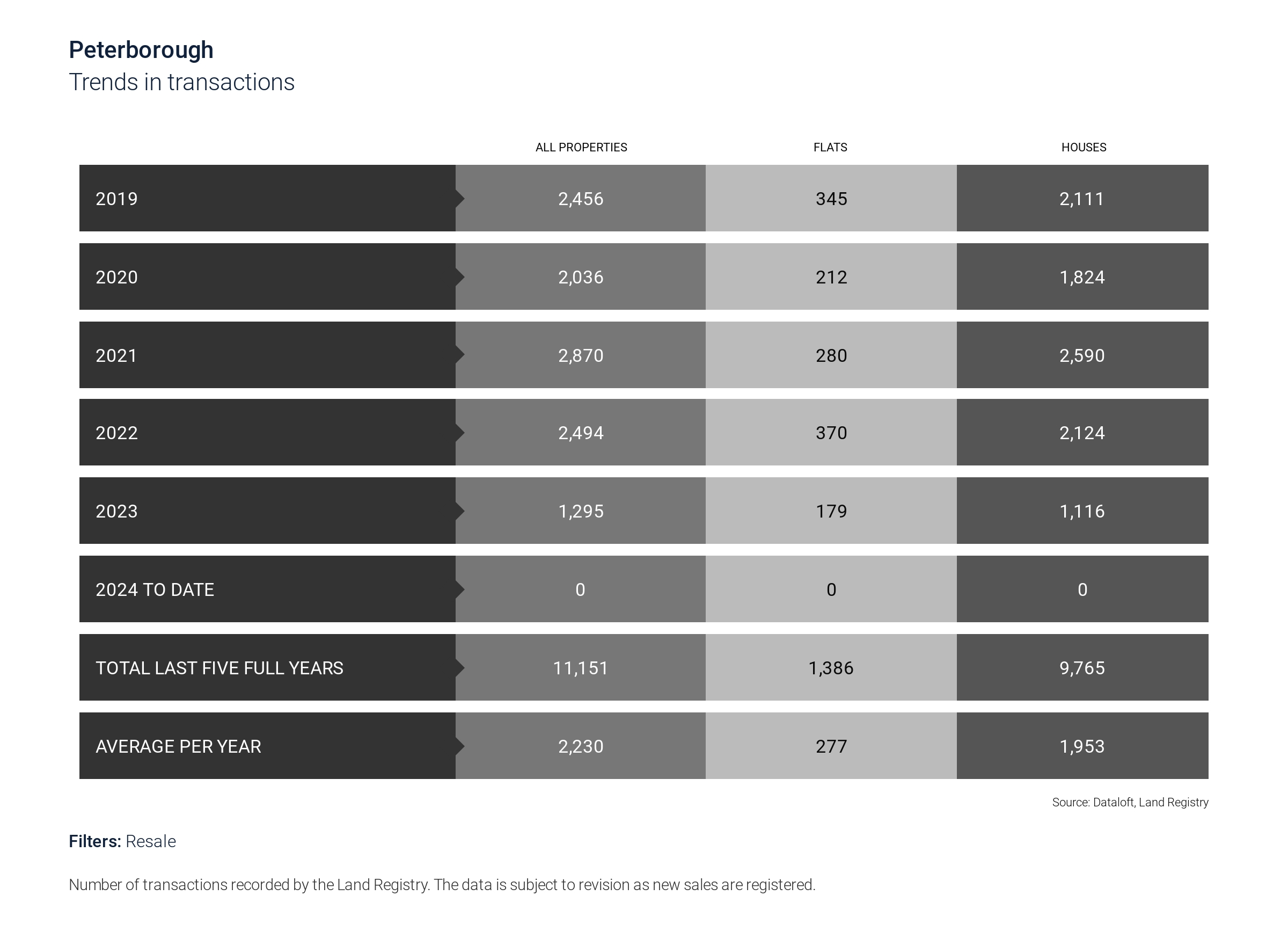

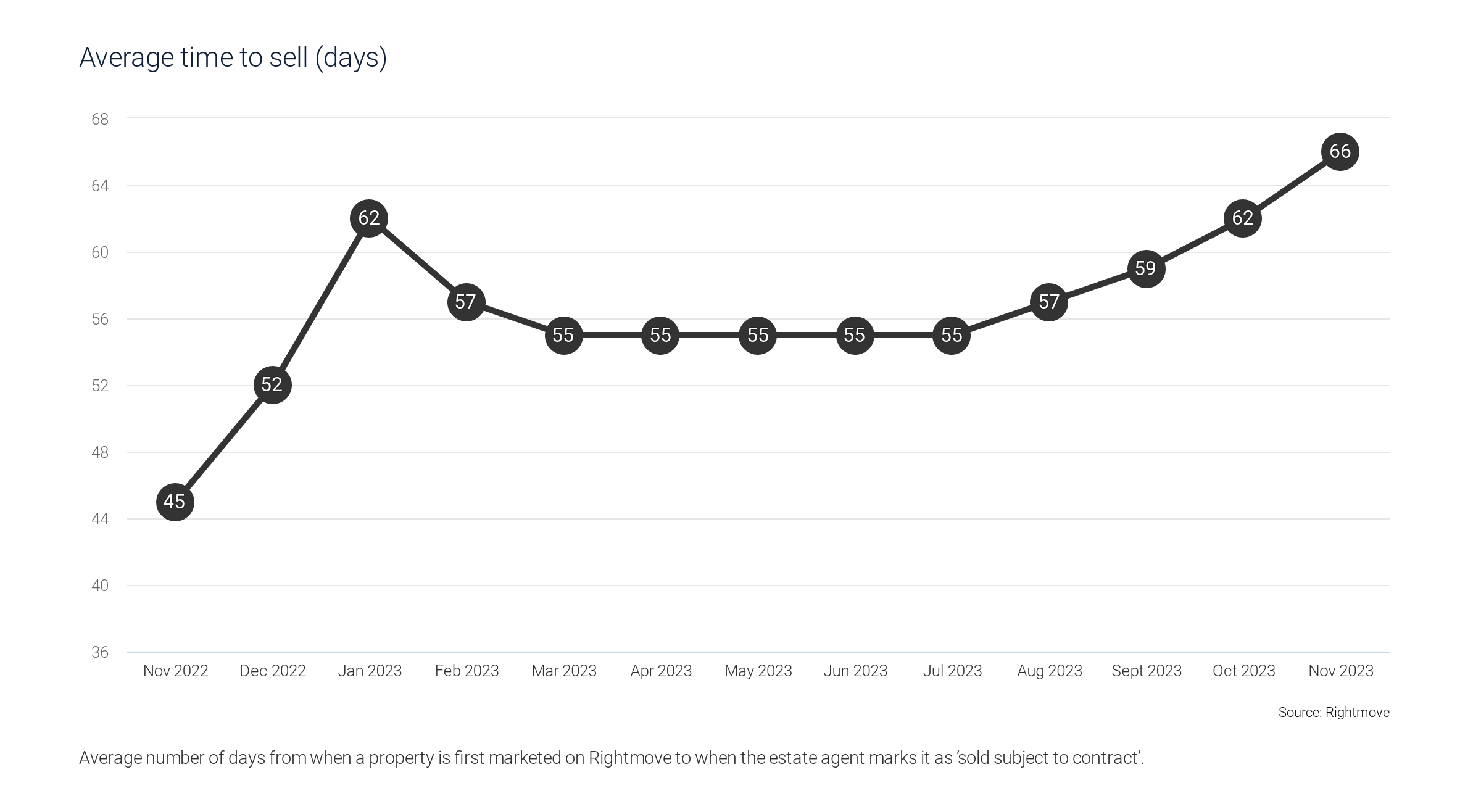

Peterborough’s property transactions reveal a notable dip, with 2023’s numbers falling to 1,295 from 2,494 in 2022, a downward trend mirrored by the increase in the average time to sell a property—up to 66 days in November 2023 from 45 days in November 2022. This data, set against a broader national economic outlook showing a contraction in house prices, a rise in unemployment, and adjustments in the official bank rate, paints a challenging picture for the near future.

The local property transaction figures, mixed with slight GDP growth and forecasts of a decrease in inflation and bank rates for 2024, suggest that while immediate concerns persist, there may be light at the end of the tunnel.

Verdict: Cautious Optimism Amidst Adjustment (mixed)

The mixed economic indicators—coupled with a slower yet consistent transaction rate—point to a period of adjustment for Peterborough’s housing market. With an anticipated easing of economic pressures, there’s cautious optimism for stability and a potential gradual upturn in the market’s fortunes in the coming year.

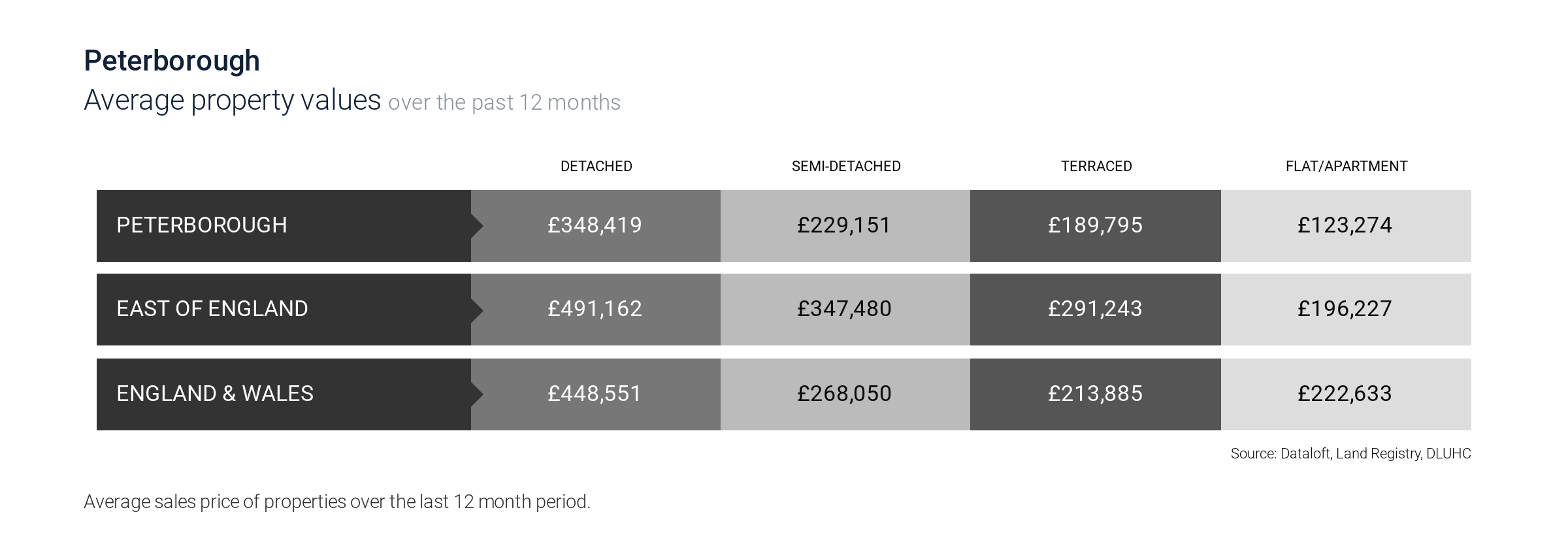

Peterborough’s Housing Market in Focus: A Comparative Analysis of Property Values

Peterborough’s property market over the past year has shown a varied landscape in terms of average property values. Detached homes in the area have an average value of £348,419, which is notably lower than the East of England’s average of £491,162 and even the overall average for England and Wales at £448,551. For semi-detached homes, Peterborough stands at £229,151, terraced at £189,795, and flats/apartments at a modest £123,274. These figures indicate that Peterborough’s market offers relatively affordable options, especially when compared to broader regional and national averages.

Verdict: Accessible Market with Room for Growth (going up)

Taking into account the economic outlook and transactional data, alongside property values, Peterborough’s housing market offers a more accessible entry point compared to the regional and national averages. Despite the current cooling, the comparatively lower house prices could position Peterborough for an upswing in market activity as broader economic conditions begin to stabilise in 2024.

Peterborough Housing Market: Our bubble summary

The Peterborough housing market, when seen through the prism of the latest economic and property data, suggests a cautiously optimistic outlook. With average property values for detached and semi-detached houses remaining below the averages for the East of England and England & Wales, Peterborough presents a more affordable entry into the property market. However, the extended average time to sell indicates a cooling market.

Recent data shows a decline in transactions, with 2023 figures significantly down from the previous year. Nonetheless, the economic forecast for 2024 hints at positive changes, with anticipated improvements in affordability for first-time buyers and a modest uptick in house price trends, reflecting a market poised for a potential rebound.

Verdict: Prospective Stabilisation (mixed)

Considering the affordability improvements, slowing inflation, wage growth, and a downward trend in the official bank rate, Peterborough’s housing market could see a stabilisation and an uptick in fortunes. While the short-term view is mixed due to current price volatility and slower sales, the long-term perspective leans toward growth, buoyed by economic recovery and improved buyer sentiment expected from spring 2024.

We continue to blow bubbles here at Tortoise Property and keep checking to see if they are on the rise, when they seem to fade and give some pointers, where possible, as to when they may burst!

So until the next time….

Fortune’s always hiding,

I’ve looked everywhere,

I’m forever blowing bubbles,

Pretty bubbles in the air.