I’m forever blowing bubbles,

Pretty bubbles in the air,

They fly so high, nearly reach the sky,

Then like my dreams they fade and die.

A song written in 1919 in the States and made famous in the music halls of Britain in the 1920s. Football fans will instantly relate the tune to West Ham United however the song could have also been adopted by the UK press when discussing the housing market cycles.

So where are we in the cycle of housing bubbles, is the bubble rising, fading or ready to burst?

Let’s look at the individual areas effecting our property market in Peterborough from June 2023 onward to understand what 2024 might bring:

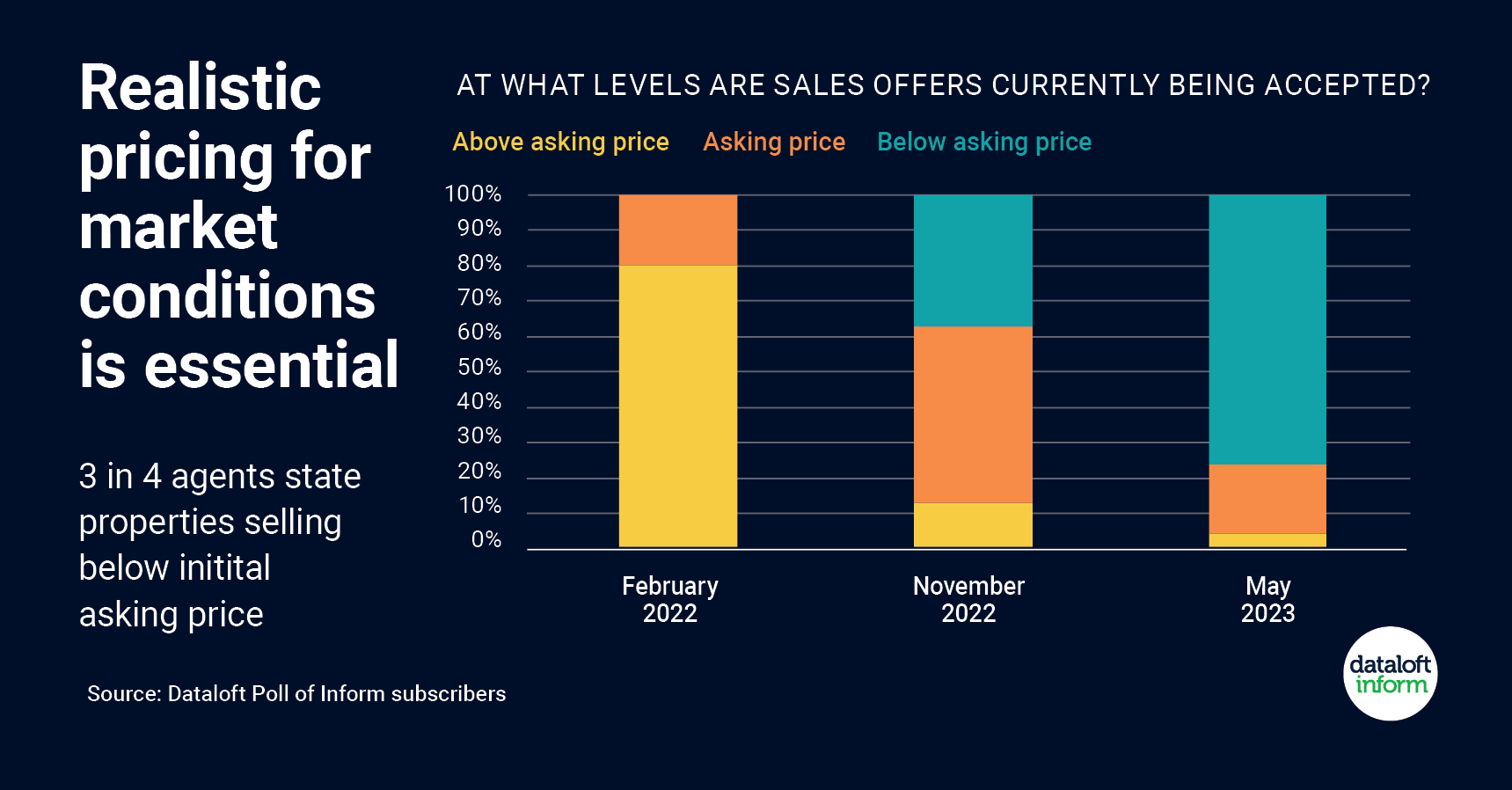

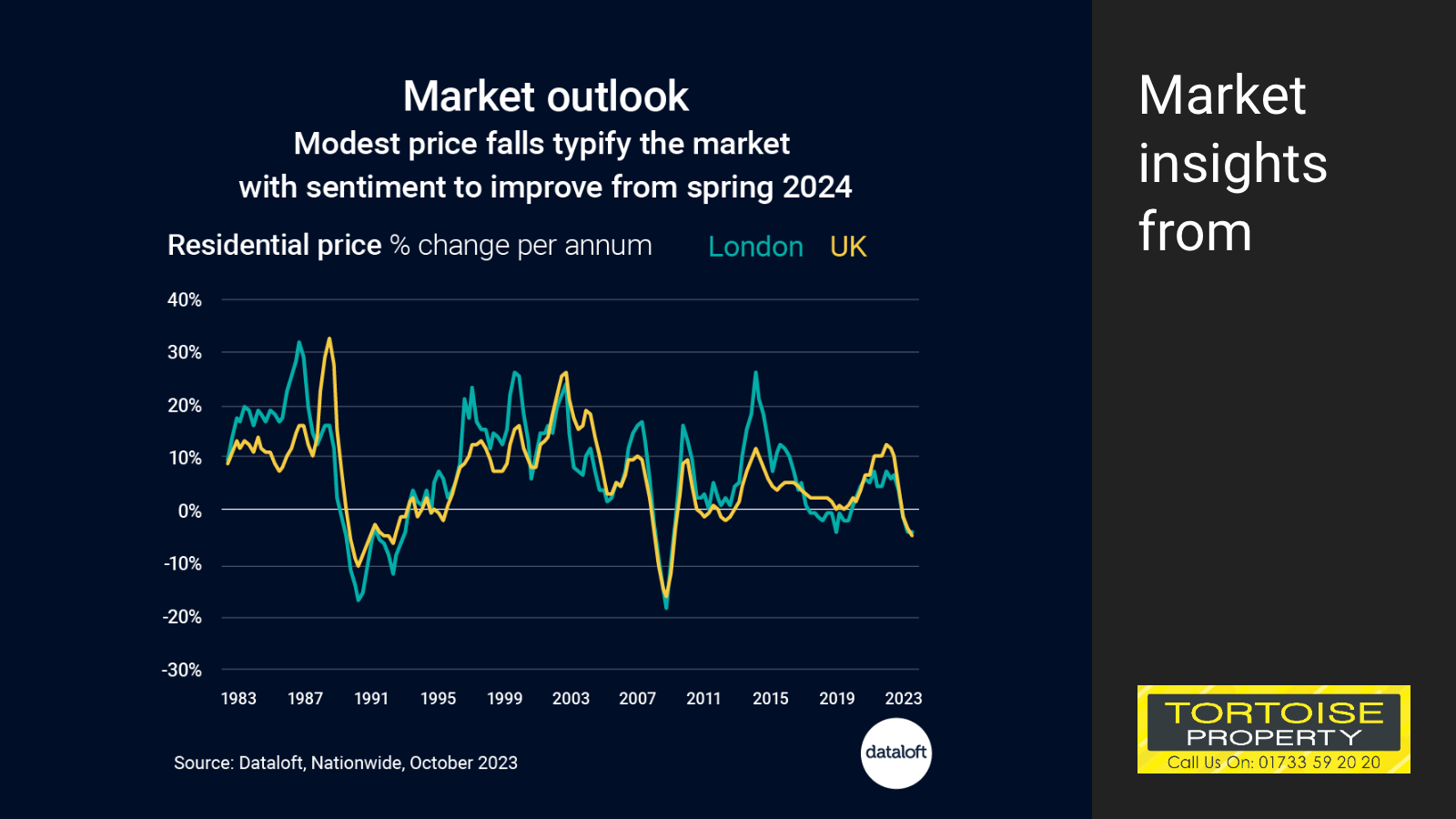

Verdict: Cautious Downturn (going down)

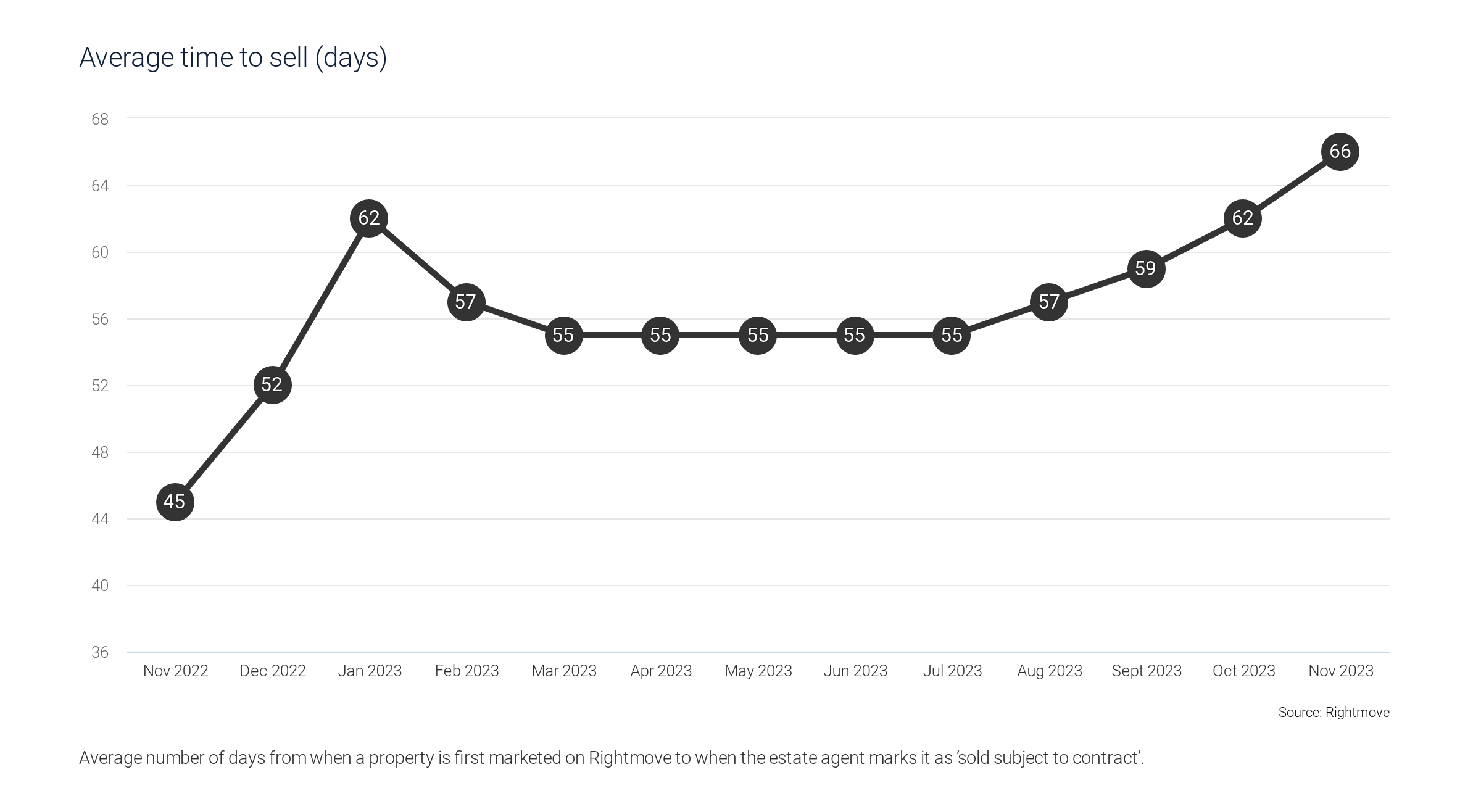

These indicators suggest the UK housing market is experiencing a cautious downturn. The gap between asking and selling prices reflects a market recalibrating to more realistic valuations, moving away from the optimism seen in the preceding months. This shift points towards a more tempered, perhaps more sustainable market trajectory.

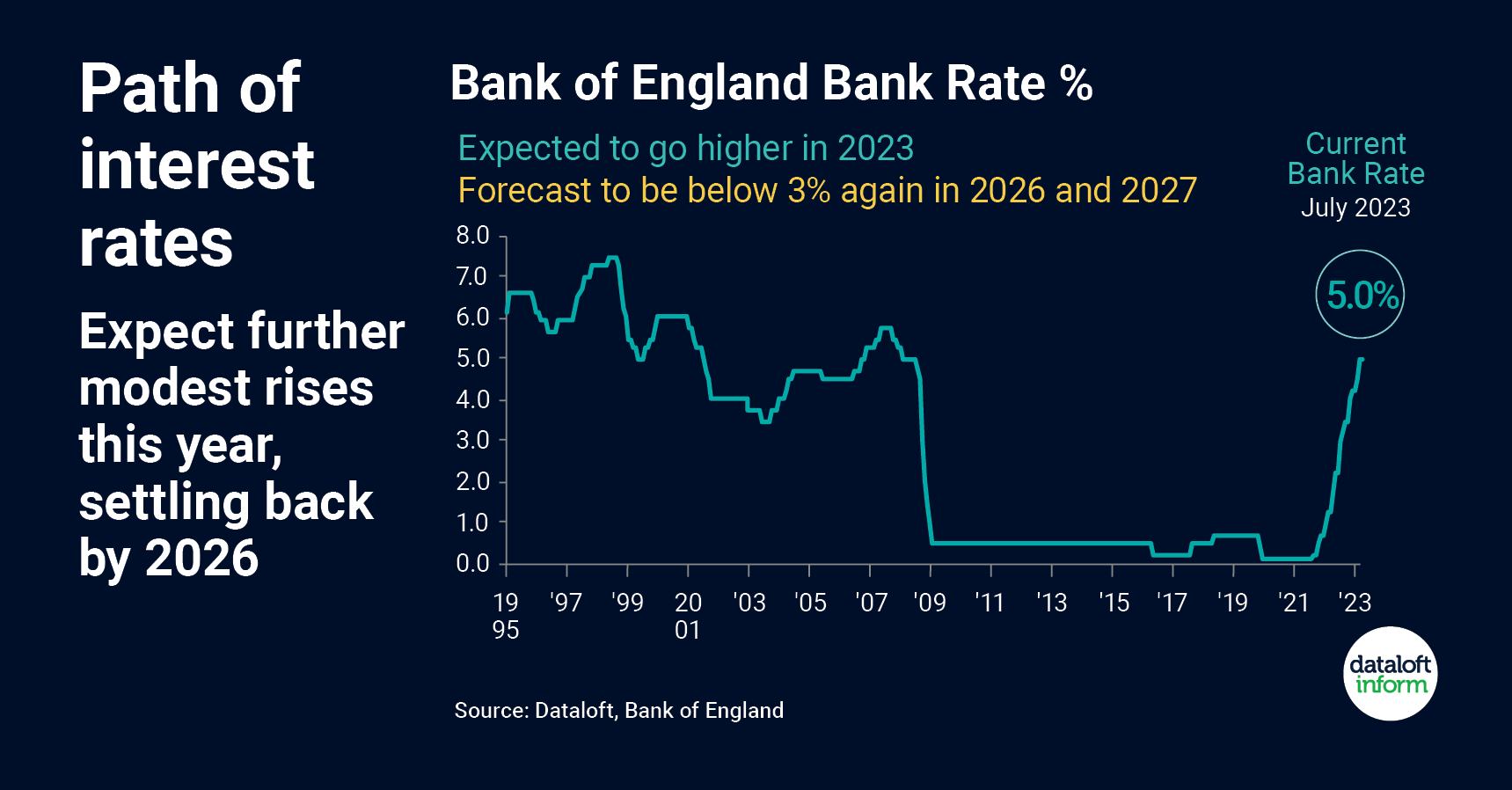

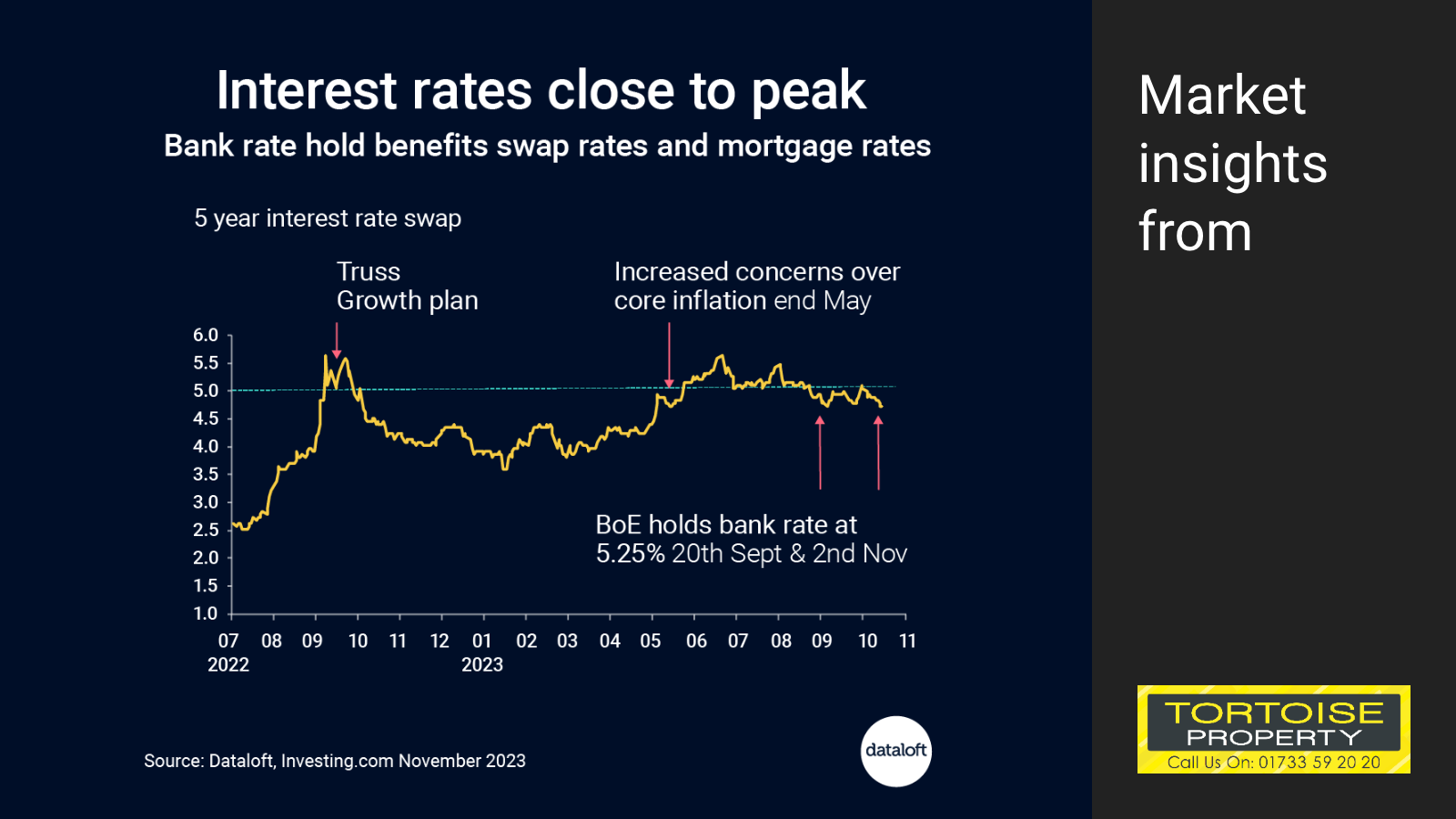

Verdict: Mixed Outlook

Given these dynamics, the UK housing market’s future appears mixed. While short-term challenges due to rising interest rates are evident, the anticipated long-term reduction in rates and improving inflation figures suggest potential stabilisation in the coming years. This balance of immediate pressures and future prospects points to a period of uncertainty followed by gradual recovery.

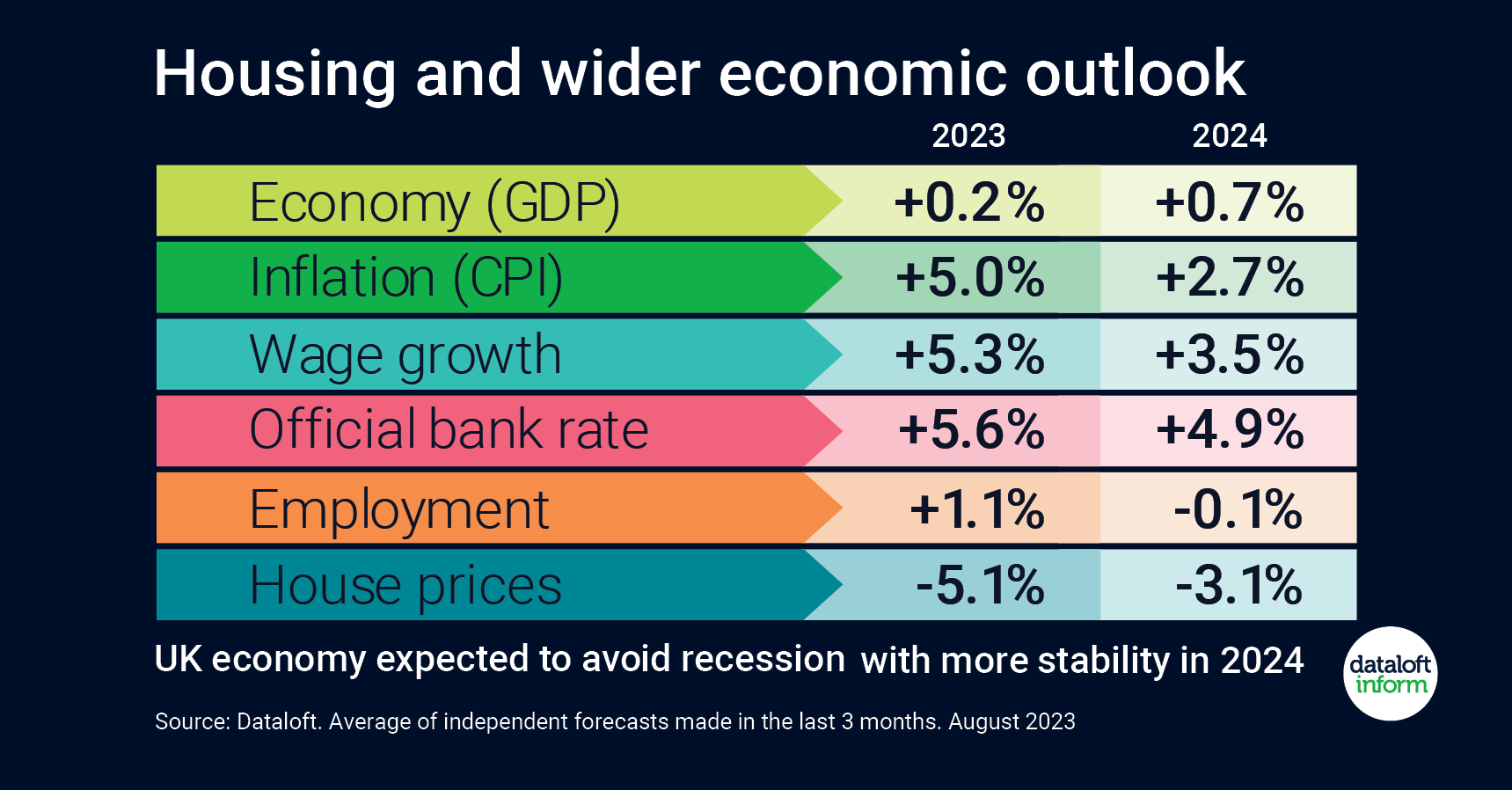

Verdict: Cautiously Upward (going up)

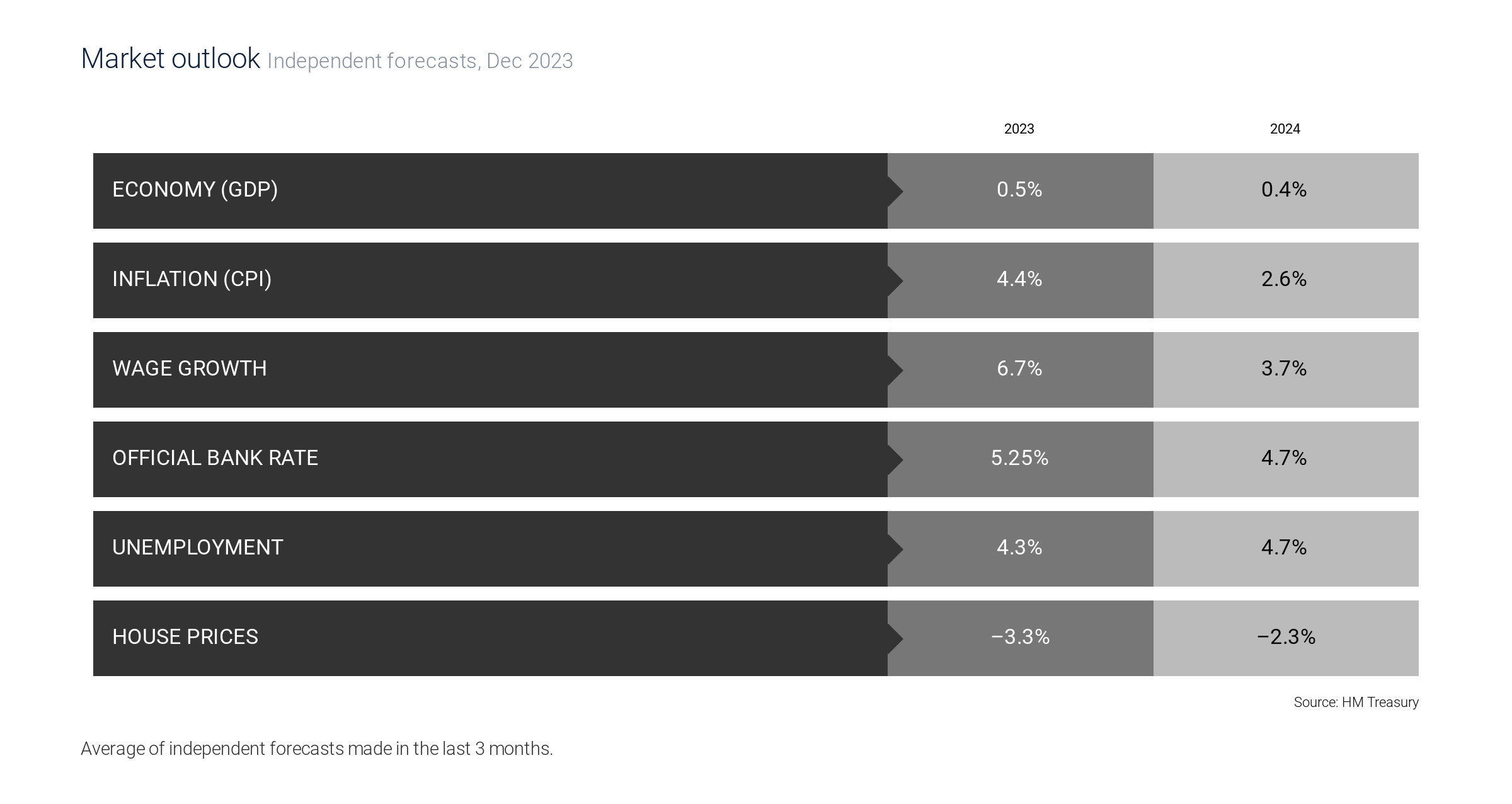

The synthesis of economic forecasts suggests a cautiously upward trend for the UK housing market. Prices may wobble as the market finds equilibrium, but the avoidance of recession coupled with supportive fiscal policies could bolster market confidence, offering a stable, if not entirely robust, outlook for the near future.

Verdict: Cautiously Optimistic (going up)

The recovery in mortgage approvals, coupled with positive inflation trends and anticipated easing of interest rates, points towards a cautiously optimistic outlook for the UK housing market. The revival in approvals indicates the first shoots of recovery, suggesting that the market might gradually regain its footing after a tumultuous period.

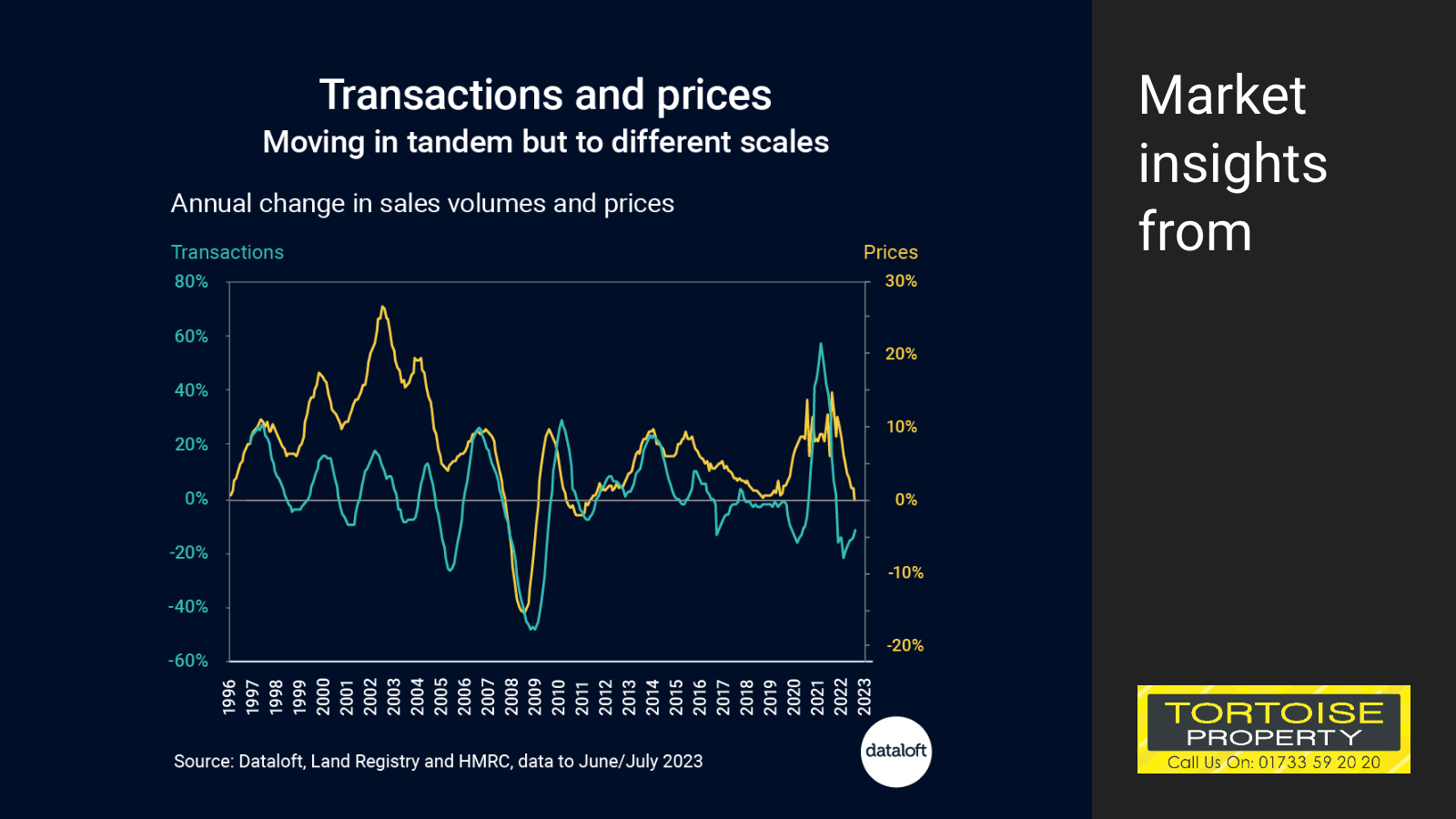

Verdict: Resilient Pricing Amidst Lower Sales Volume (mixed)

This data suggests that although the UK housing market is experiencing a reduction in sales volume, it doesn’t necessarily equate to a parallel fall in property prices. The market appears to be showing resilience in terms of pricing, even as the number of transactions moderates from the pandemic-induced highs.

Verdict: Guarded Upturn (going up)

This analysis points towards a cautiously optimistic outlook for the UK housing market. While short-term challenges persist, the overall trend suggests a gradual movement towards stabilisation and growth, albeit contingent on maintaining a balanced approach to interest rates and inflation.

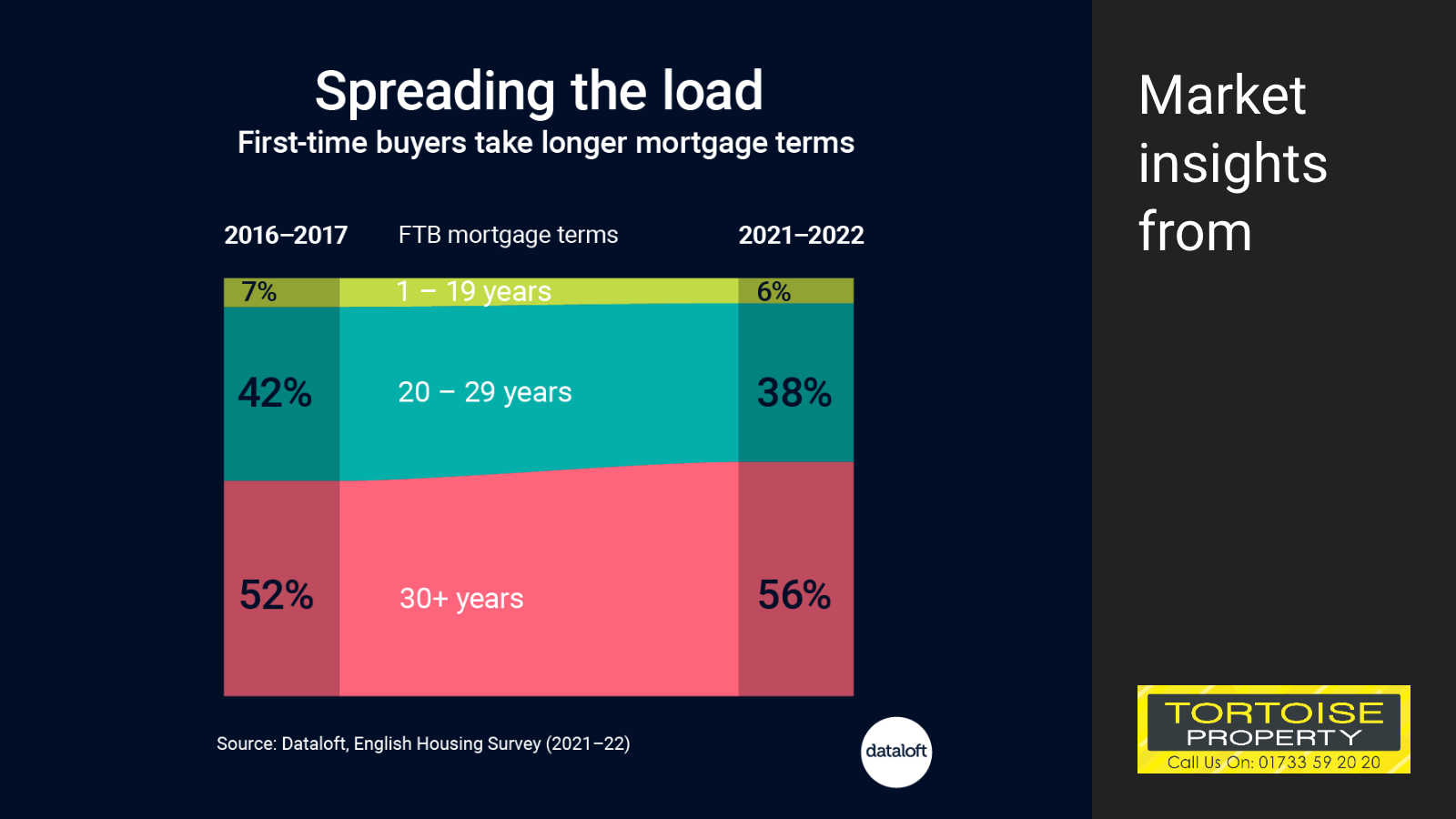

Verdict: Resilient but Strained (mixed)

This shift towards longer mortgage terms among first-time buyers suggests a resilient yet strained response to the UK’s rising housing costs. While these strategies demonstrate adaptability, they also highlight the increasing financial pressures faced by new entrants into the housing market. The situation presents a mixed outlook: a market that is still accessible but requires greater financial stretching for new homeowners.

Verdict: Tentative Recovery on the Horizon (going up)

The UK housing market appears poised for a gradual recovery. The stabilisation or reduction in interest rates expected in the near future is likely to inject some optimism into the market. While immediate challenges remain, the outlook for 2024 hints at improving conditions, fostering a cautiously optimistic view for the housing sector’s fortunes.

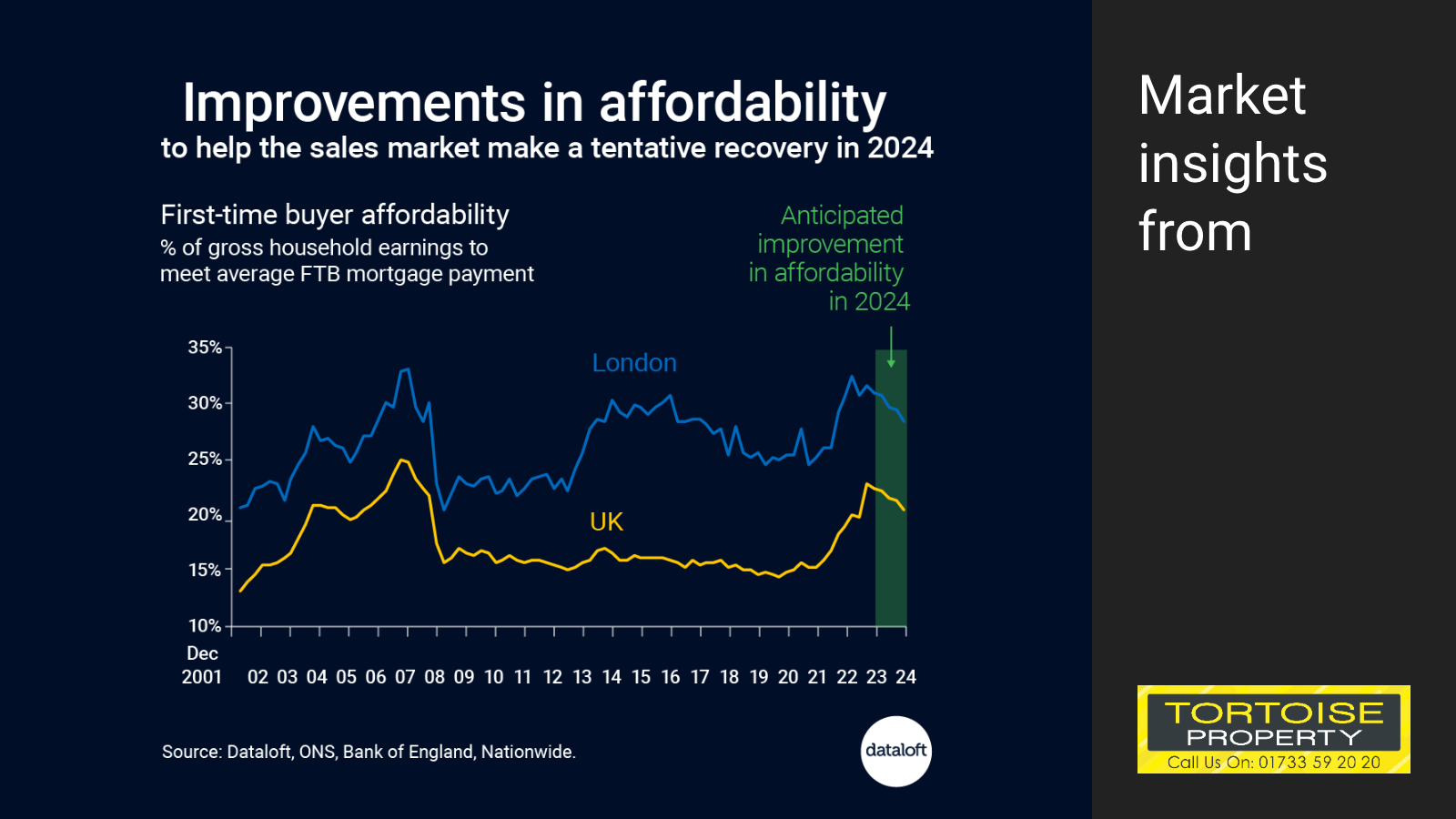

Verdict: Cautious optimism for 2024 (going up)

The convergence of these factors – lower swap rates, expected earnings growth, and stabilising property prices – paints a cautiously optimistic picture for the UK housing market. While immediate challenges persist, the improving affordability scenario points towards a gradual recovery in buyer confidence and market activity in the coming year.

Verdict: Struggling sales and robust rentals (mixed)

With a slight dip in 2024 but a rebound in the following years, the UK housing market is set for a mixed but optimistic future. The robust rental sector underpins a gradual but positive shift in the market, signalling an uptick in the market’s fortunes from 2025 onwards.

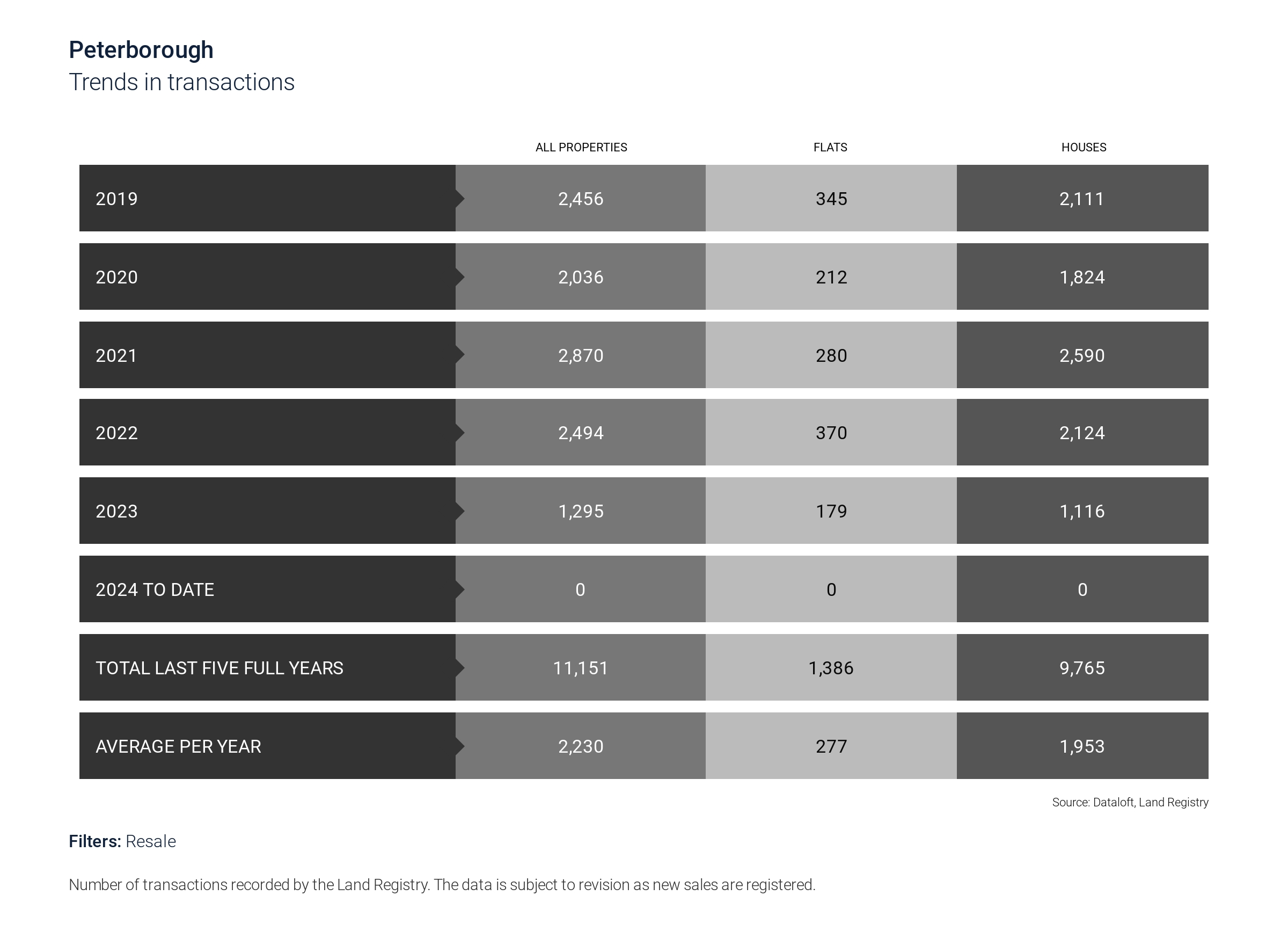

Verdict: Cautious Optimism Amidst Adjustment (mixed)

The mixed economic indicators—coupled with a slower yet consistent transaction rate—point to a period of adjustment for Peterborough’s housing market. With an anticipated easing of economic pressures, there’s cautious optimism for stability and a potential gradual upturn in the market’s fortunes in the coming year.

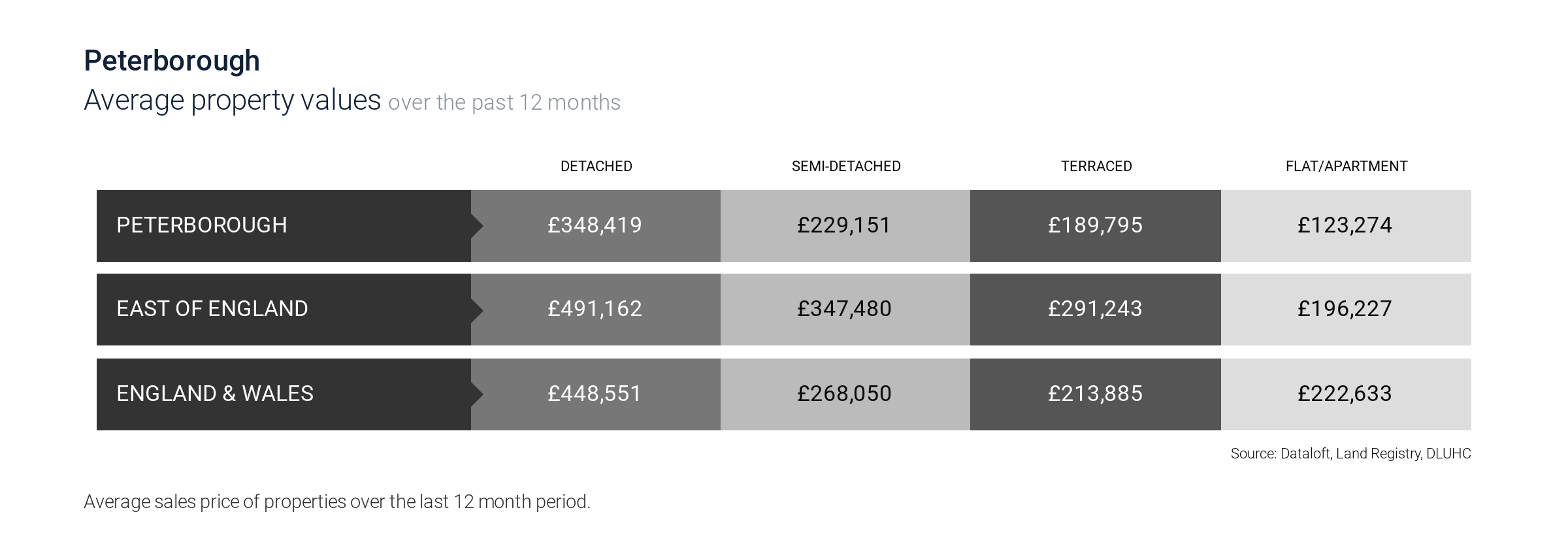

Verdict: Accessible Market with Room for Growth (going up)

Taking into account the economic outlook and transactional data, alongside property values, Peterborough’s housing market offers a more accessible entry point compared to the regional and national averages. Despite the current cooling, the comparatively lower house prices could position Peterborough for an upswing in market activity as broader economic conditions begin to stabilise in 2024.

Peterborough Housing Market: Our bubble summary

The Peterborough housing market, when seen through the prism of the latest economic and property data, suggests a cautiously optimistic outlook. With average property values for detached and semi-detached houses remaining below the averages for the East of England and England & Wales, Peterborough presents a more affordable entry into the property market. However, the extended average time to sell indicates a cooling market.

Recent data shows a decline in transactions, with 2023 figures significantly down from the previous year. Nonetheless, the economic forecast for 2024 hints at positive changes, with anticipated improvements in affordability for first-time buyers and a modest uptick in house price trends, reflecting a market poised for a potential rebound.

Verdict: Prospective Stabilisation (mixed)

Considering the affordability improvements, slowing inflation, wage growth, and a downward trend in the official bank rate, Peterborough’s housing market could see a stabilisation and an uptick in fortunes. While the short-term view is mixed due to current price volatility and slower sales, the long-term perspective leans toward growth, buoyed by economic recovery and improved buyer sentiment expected from spring 2024.

We continue to blow bubbles here at Tortoise Property and keep checking to see if they are on the rise, when they seem to fade and give some pointers, where possible, as to when they may burst!

So until the next time….

Fortune’s always hiding,

I’ve looked everywhere,

I’m forever blowing bubbles,

Pretty bubbles in the air.