So it’s been what I have now become to know as a ‘crunch’ week. I have now lived through a few and learnt to take a step back, breathe, accept the change and just go with it.

My first crunch week was the first week in September 2007 as another recession was born out of a credit crunch. It’s why I call them crunch weeks.

The second was when austerity was announced in 2010 followed by the Brexit referendum, then the Covid announcement when sadly Boris Johnson explained that people in high numbers would die. Then Russia invaded Ukraine followed by the Energy Crises and now Trusenomics.

Each event caused our industry to assess our local markets and accept that change is upon us.

So what is happening?

The housing market is under pressure. Some of this pressure was expected, shown in forecasts where prices stabilise, even re-adjust by 2% – 3% over the next 12 months however, these forecasts have now accelerated due to recent events. When acceleration happens re-adjustments becomes stronger and decisions that people make become driven by fear and impatience which again, like acceleration, causes a reaction bigger than should be seen.

So what can you see?

- Price reductions of ‘overpriced’ homes that are on the market for sale. Increasing downward pressure on what should be stable house prices, for those properties that have been priced appropriately.

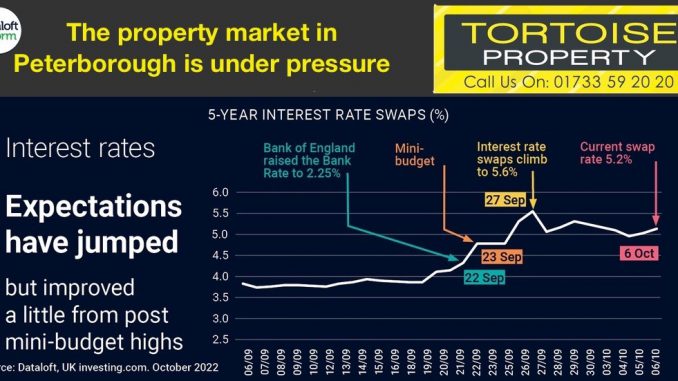

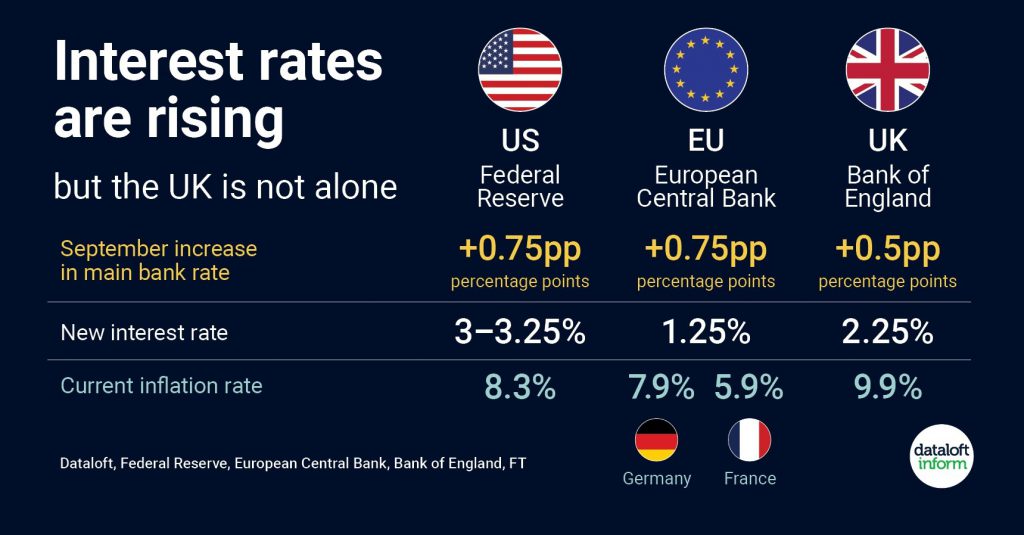

- Increased interest rates on mortgage products, all priced into the market weeks prior to the Bank of England rate announcements. This is all due to falling gilt / bond prices effecting swop rates for mortgage lenders placing further pressure on buyer affordability.

- Decreasing buyer demand as confidence declines in the forward movement of sale prices as the media describes only the worst case scenarios.

- An increased visible stock of availability homes to buy, providing more choice. Yet buyers are pausing and taking stock, assessing the options and their next steps.

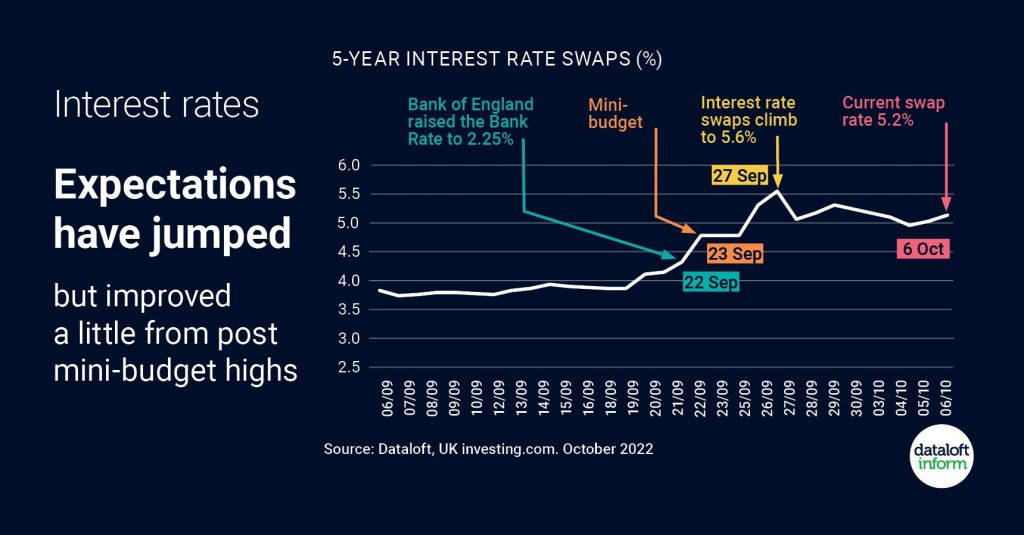

- An increasing number of days it is taking to sell a home in the UK. Moving upward from the low of 31 days seen in April this year.

Has the housing market just overheated?

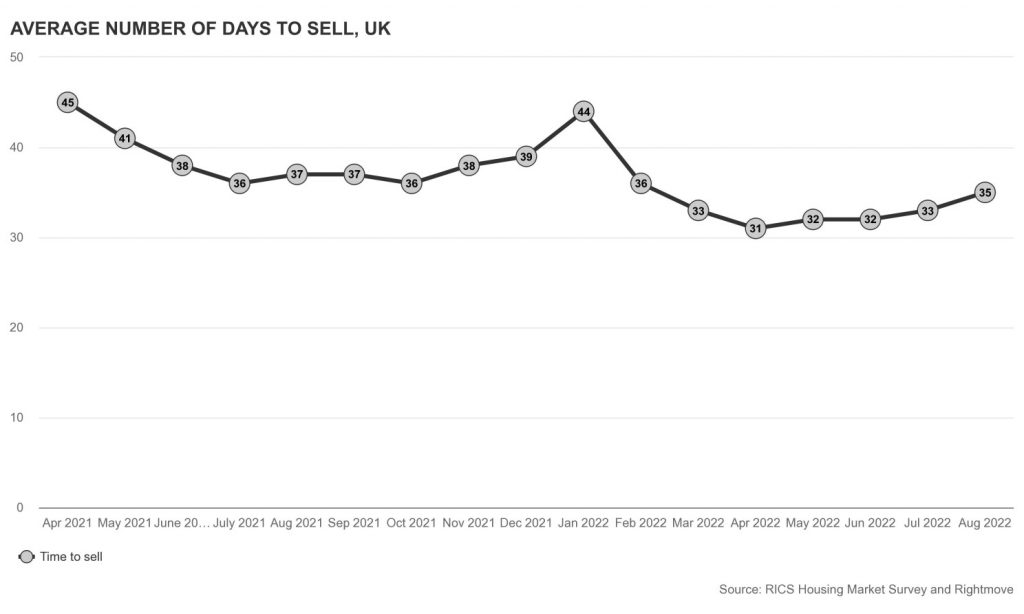

Locally, I don’t think so. The average house sale price to August in Peterborough (£205,270) is both below the average for England and Wales (£262,171) and the East of England (£322,848). Our City has performed consistently in the top ten Cities in the country for economic growth in the past few years with low unemployment, investment in infrastructure (including our new university), job growth and new homes built around the City in large numbers.

So what has caused the housing market to stall this past week?

Well Trusenomics has been the accelerant for issues that have been building. These include Increasing energy prices, increasing inflation, the requirement by the Bank of England to increase interest rates, spiralling borrowing requirements, decreasing tax returns and an ageing generation of ‘boomers’ with an increasing overall population that does not seem able to increase national productivity.

Housing has been one of only a few investment markets that have so far been immune to the effects of these issues during the past two years. However, they have now grown to a point where the events of the world around us have now negatively effected the three main things we all require to survive, energy, food and now shelter.

Trusenomics, as an ideology, I can personally understand which gives an alternative to true austerity and low productivity however, an ideology alone is not enough. Detail, understanding, buy-in is and a sensible plan required.

Without this we have seen the ideology be used to seed fear in currency markets, gilt markets, pension markets, political arenas and now the housing market through the intervention of the Bank of England. The use of interest rates to leverage control of overall inflation due to volatility in a number of markets is not something we see normally. Normally the Bank of England would only use interest rates to control an overheated housing market, that in normal times would be seen as the biggest risk to cause high inflation in the UK.

So what now?

Well life goes on, it always does, and has done through a recession, austerity, Brexit, Covid, a war in Ukraine, an energy crisis and now a housing market that is returning to normal conditions through a hand break turn rather than a controlled slow down. It is normal to have interest rates well above 0.5%, probably settling at levels around 4% to 5%, house price growth at a rate of 2-3% per year rather than 10%+ and homes being sold over a period of weeks rather than days.

To get to normal, the hand brake will probably see us with higher than average interest rates for a period, a re-adjustment of house prices and a period of extended timeframes for property sales however, it will settle back into a normal rhythm. This has to be the goal else this continual unbalanced turmoil will be ongoing. You could say on a boom and bust basis.

SO….

The great house buying rush has ended, maybe never to be seen again in my lifetime. Yet the transition to a normal market is going to be bumpy, like so many other areas of our economy as we stabilise them and learn how to restructure them for the future.

This does not mean a CRASH in house prices. For that to happen people have to be under intense pressure to sell against their wishes and although people have taken a step back I have not seen intense pressure on sellers to sell the security that a home offers a person, couples and families. I hope we will see a stabilisation through adjustments in a number of financial markets over the coming weeks / months and we all pass through another CRUNCH week brought on by poor politics and media fear mongering.

Mike Matthews

Tortoise Property

01733 592020