Happy New Year to all, I know I’m a couple of weeks late however, Covid finally got me! So here’s to an exciting 50 week year starting right now, here we come 2022!

So let’s start with that fantastic pastime of forecasting. And it does not matter how many times you get it right we always remember Michael Fish, the BBC weatherman in 1987, well if you’re old enough!

“Earlier on today apparently, a woman rang the BBC and said she’d heard there was a hurricane on the way,” he confidently told viewers.

“Well, if you’re watching, don’t worry, there isn’t.”

It was one of the last broadcasts before the Great Storm of 1987, which hit the UK with winds of up to 115 mph, the most damaging storm to hit the UK since 1703.

I’m sure Michael Fish wished, along with his satellites, he’d had a working crystal ball on that day.

Carol Lewis from the Times newspaper wrote in her column (December 2021) that in September 2020 the Centre for Economics and Business Research predicted that property prices would drop by almost 14% in 2021, Ooops!

So what did happen? And what can we expect in 2022, hopefully no Great Storms!

2021 round up

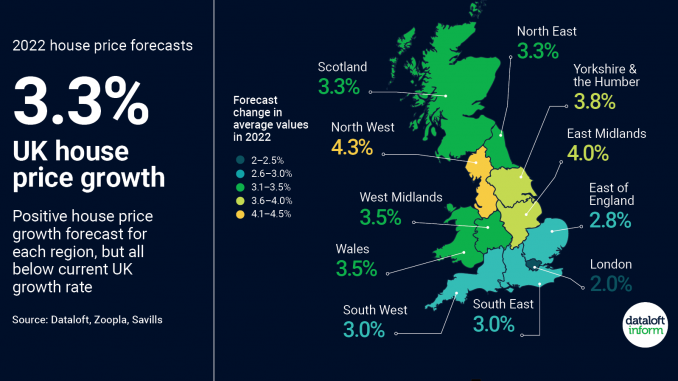

January to June 2021 – What a run of house price growth at 13.2%!

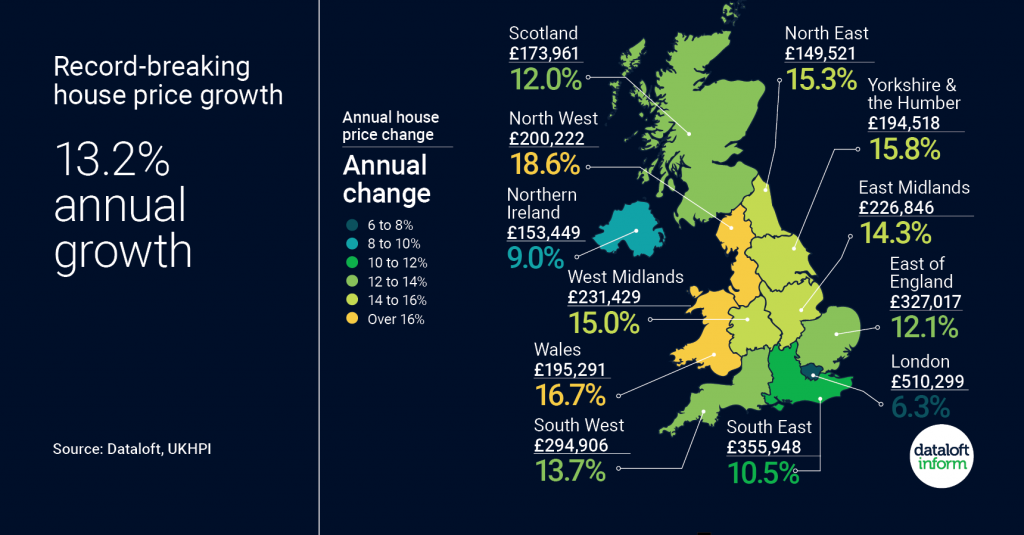

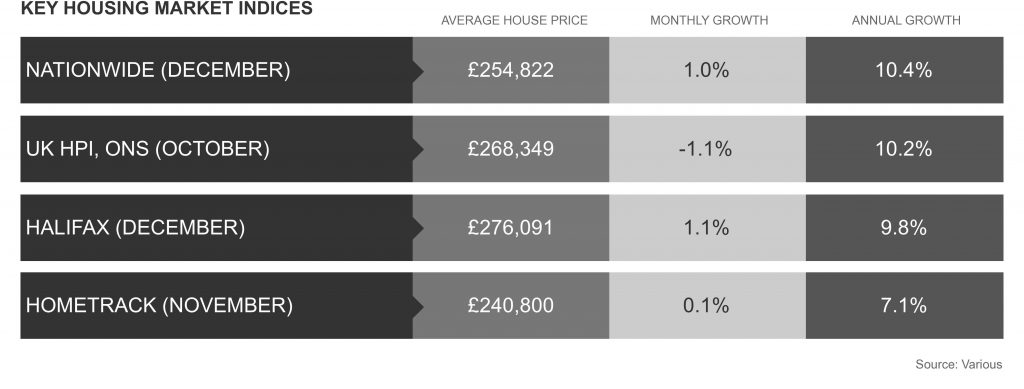

This is how it eventually finished in December 2021. An annual increase of 10.4%

My summary of 2021

The housing market proved to be one of the brightest stars during the initial Covid-19 pandemic, bolstered by the significant government economic support packages and the stamp duty holiday.

According to the Yorkshire Building Society some 408,379 first time buyers have climbed onto the property ladder in 2021. And with two months of data yet to be reported, 2021 has already seen the highest level of completed home sales since 2007, and Rightmove expects 1.5 million transactions to have taken place for the full year (2021) once the reporting has been fully completed.

This, along with average increases in prices of 10.4% drove increased confidence into the housing market throughout the country and once again brought us back to being a nation with the aspiration of being home owners.

So, what’s next – 2022 forecast

My Summary of the forecast for 2022

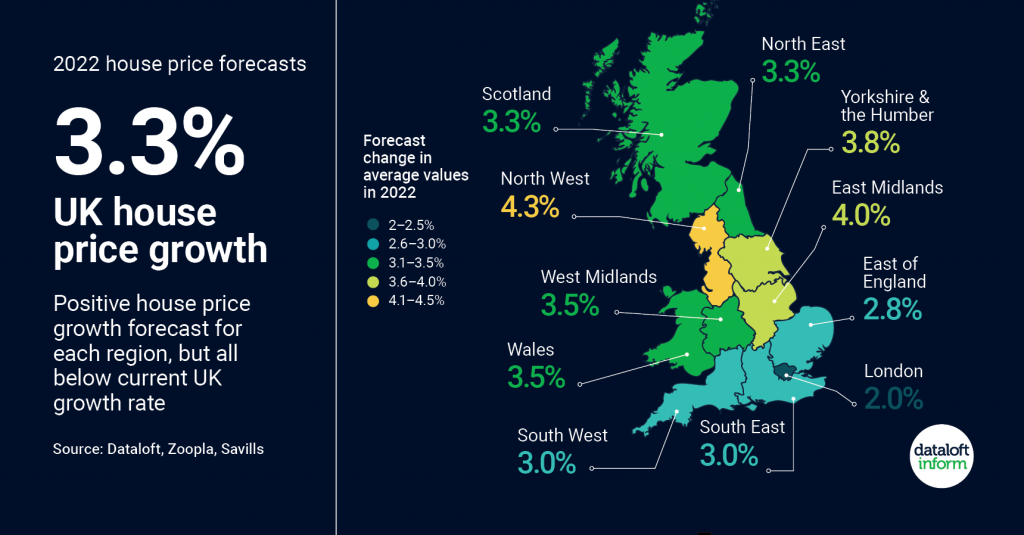

The impact of the Omicron variant is yet to play out, but more limited government support and a rise in the cost of living may well squeeze household budgets more tightly than expected in 2022. UK forecasters still predict house price growth of between 1% to 5% across the country due to the lower level of stock and the high demand from prospective home owners.

We are expecting transaction levels across the UK to fall back to the levels seen before the pandemic at around 1.2 million transactions.

So who is buying right now?

My Summary

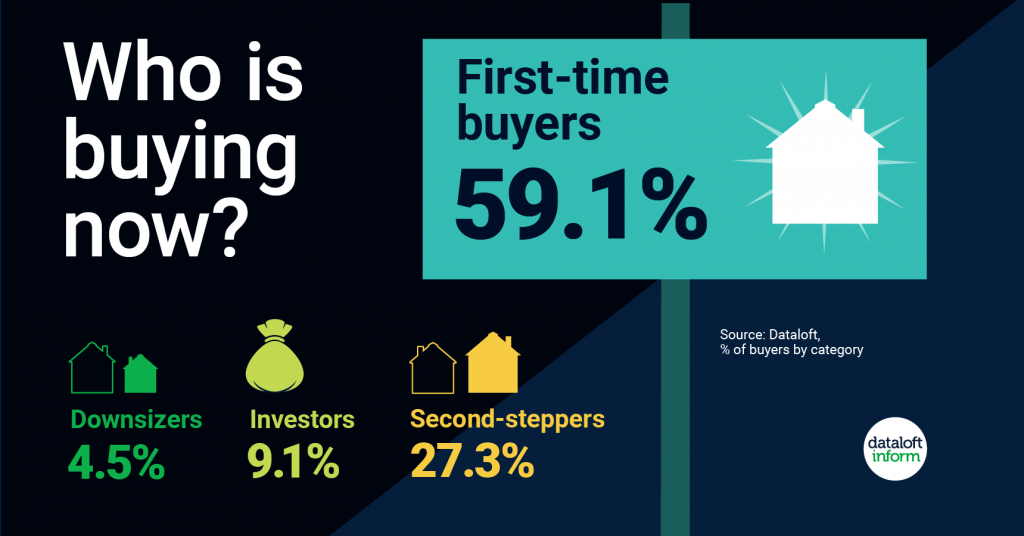

It is well known in the property world that a successful property market is driven by first time buyers, the recent poll by Dataloft showing that first time buyers are eager to purchase their first home and should continue to give confidence to second steppers going into 2022.

Down sizers are still only making up a small proportion of the moving market (4.5%) which means that many family homes are still not being released onto the UK markets where their space and location would be more suitable for growing families. National builders are providing the required three, four and five bedroom homes currently required by second steppers rather than building the appropriate homes for the older generation (bungalows). If this were happening it would release the homes of the older generation onto the market for second steppers to buy enabling the older gerneration to downsize and live in more suitable, life friendly homes and locations.

Investors are still buying, having seen rental yields grow through both rent increases and asset price increases in 2021.

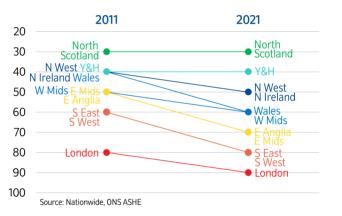

And in their Decembers 2021 House Price Index from Nationwide they identified that people living in 9 out of the 11 areas in the UK have seen affordability become more stretched over the past decade when purchasing a home. With only North Scotland and Yorkshire and Humberside experiencing similar costs to income when purchasing a home in 2021 compared to 2011.

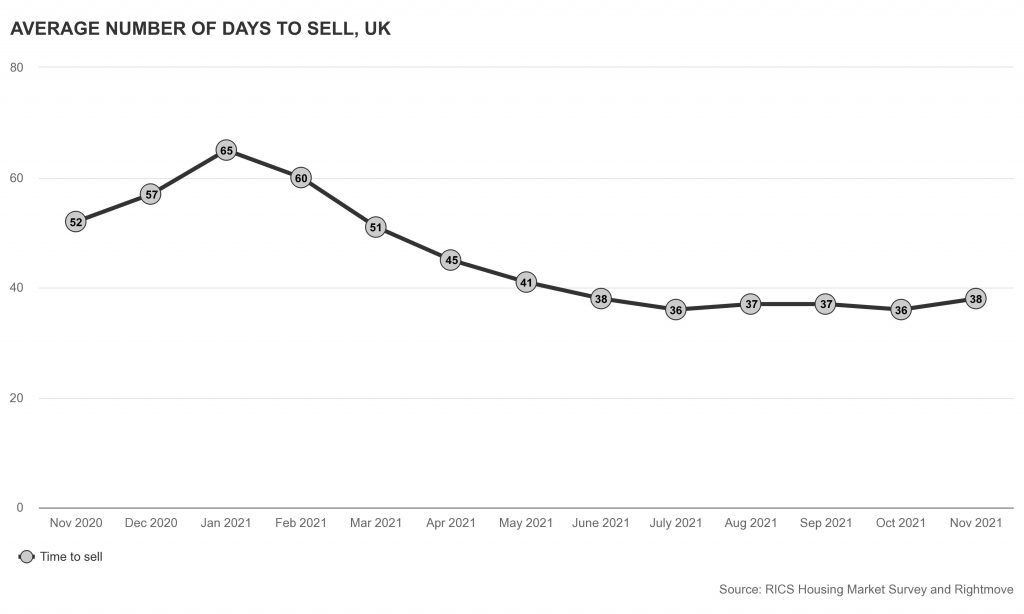

Yet we continue to see property that is marketed for sale currently only taking an average 38 days to sell in the UK.

So, there seems to be plenty of momentum for the housing market going into 2022 however an eye needs to be kept on inflation, interest rates, employment and of course the pandemic to see if this buying momentum will continue past June into the summer months.

So onto the 5 year forecast.

My summary

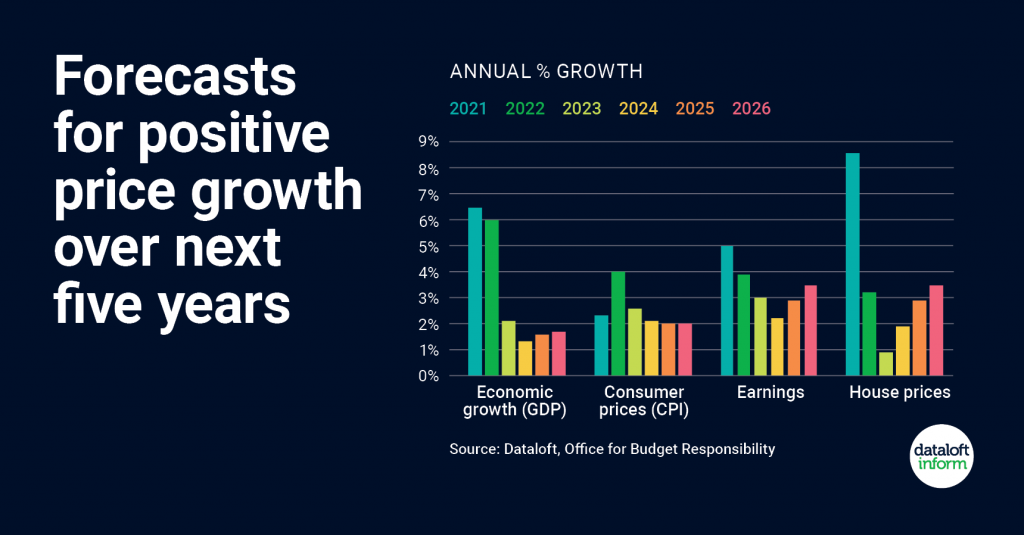

The Office of Budget Responsibility forecasts that house prices will continue to increase at a slower pace than we have experienced in 2021. Economic growth is expected to continue to increase regaining some of the lost growth during the pandemic. The hope is that after this years inflation increase, inflation will fall back to the government’s target of 2% over the next few years. There is however an expectation that wages will rise above what has become the stagnate norm of 1% over the past decade and therefore, bundled together, these metrics seem to continue to support positive increases in house prices going through to 2026.

Please feel free to comment / give your thoughts on what you think will happen to the housing market in 2022 and, if you have a working crystal ball, let me know!

Mike Matthews

Tortoise Property

01722 592020